UK Energy Market Analysis - April

In the economic environment, equity markets have shown only a modest response to the tense geopolitical situation, with the FTSE 100 trading close to...

Gas prices have been volatile in recent weeks, with the February contract reaching a high of 113.00 ppt in late January. The rally was driven by expectations of another cold wave in the second half of February, alongside rising tensions in the Middle East that have heightened concerns over potential disruptions to LNG exports from Qatar. These risks come against the backdrop of low European gas storage levels, currently at 43.5%, down 4.9 percentage points week-on-week. While the rally may extend in the near term, assuming Qatari flows remain stable, prices are likely to resume their downtrend once milder temperatures set in, Golden Pass confirms its start date and rising solar generation gains momentum.

Economic Environment

Oil

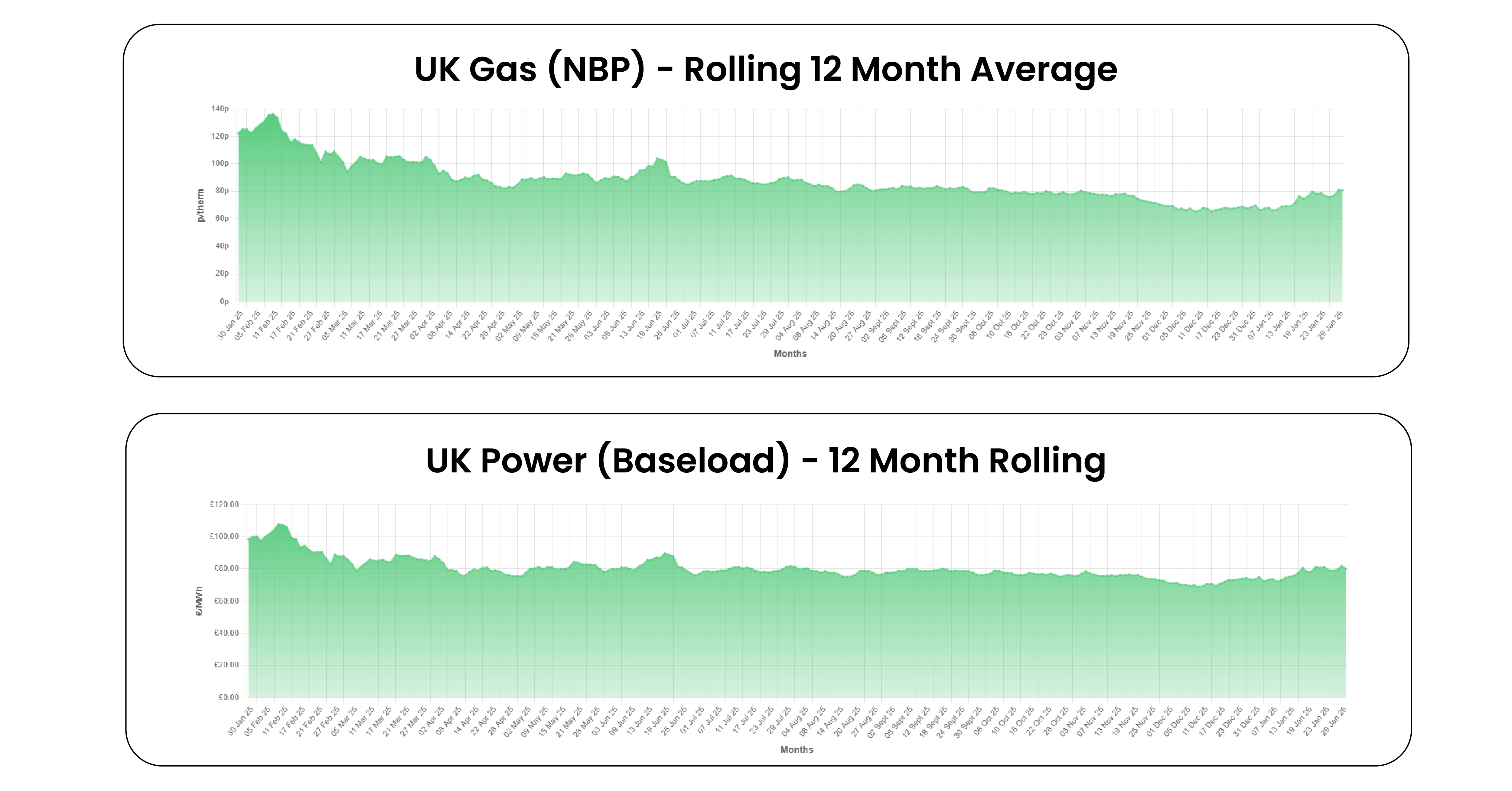

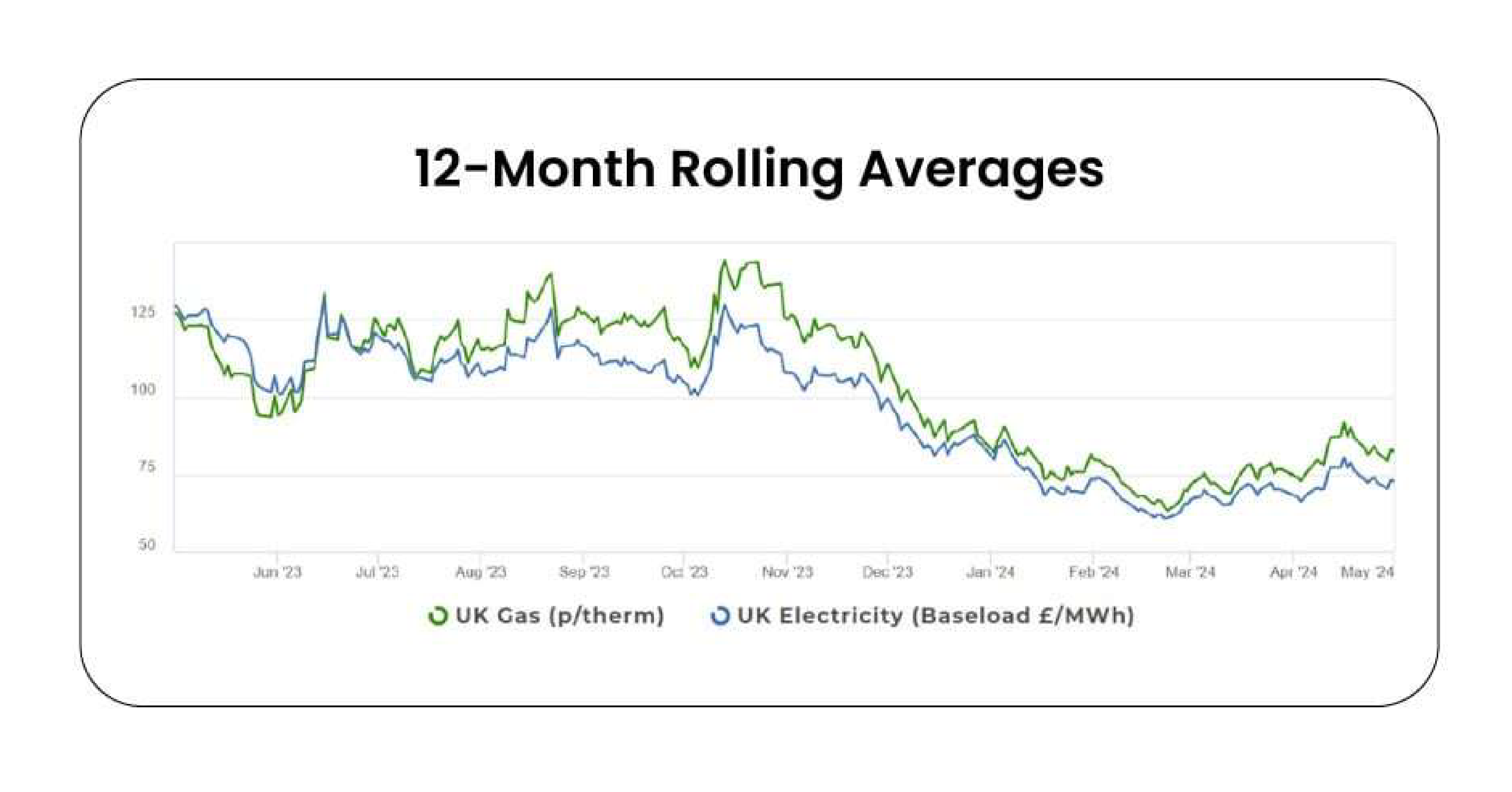

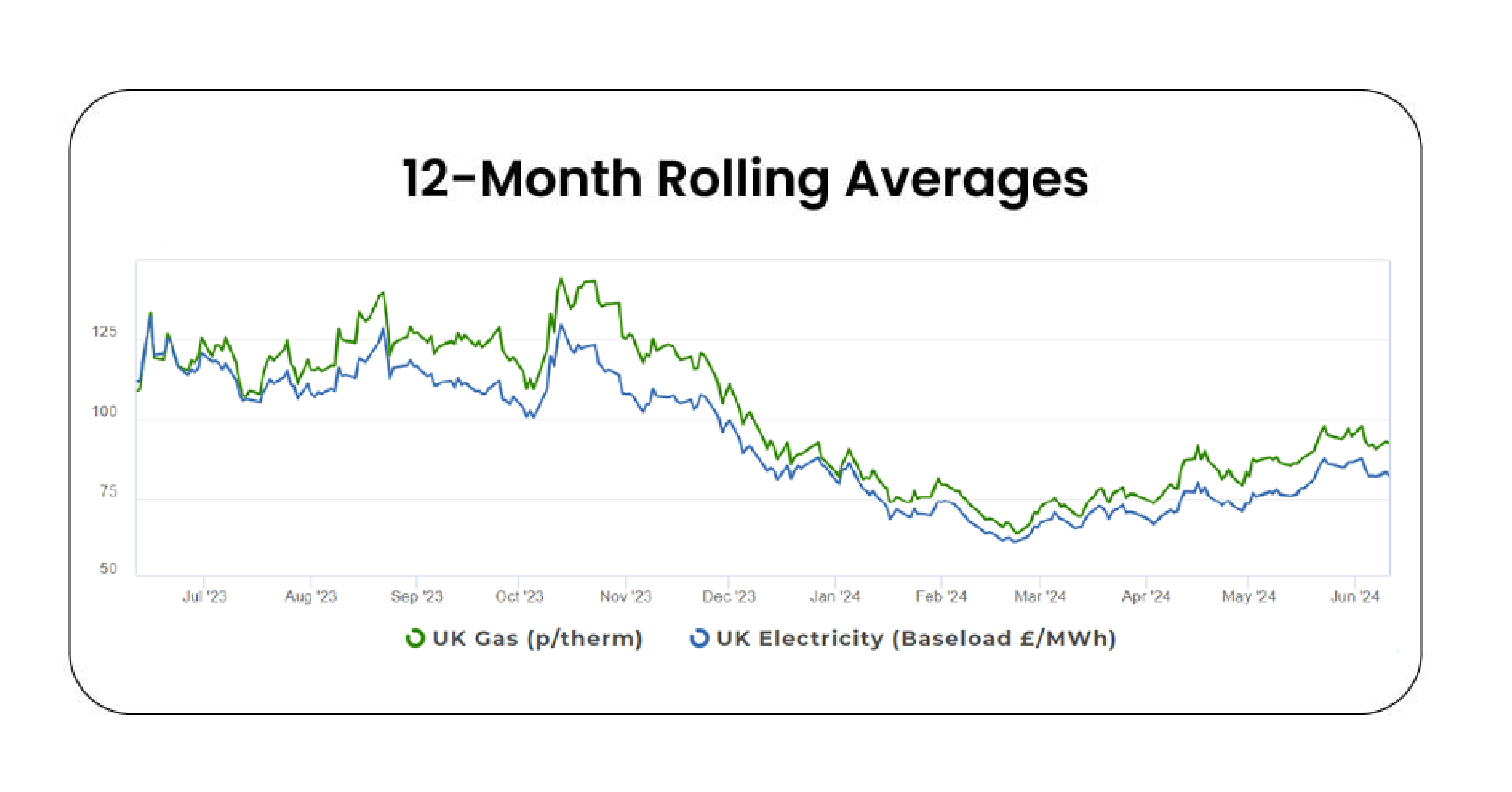

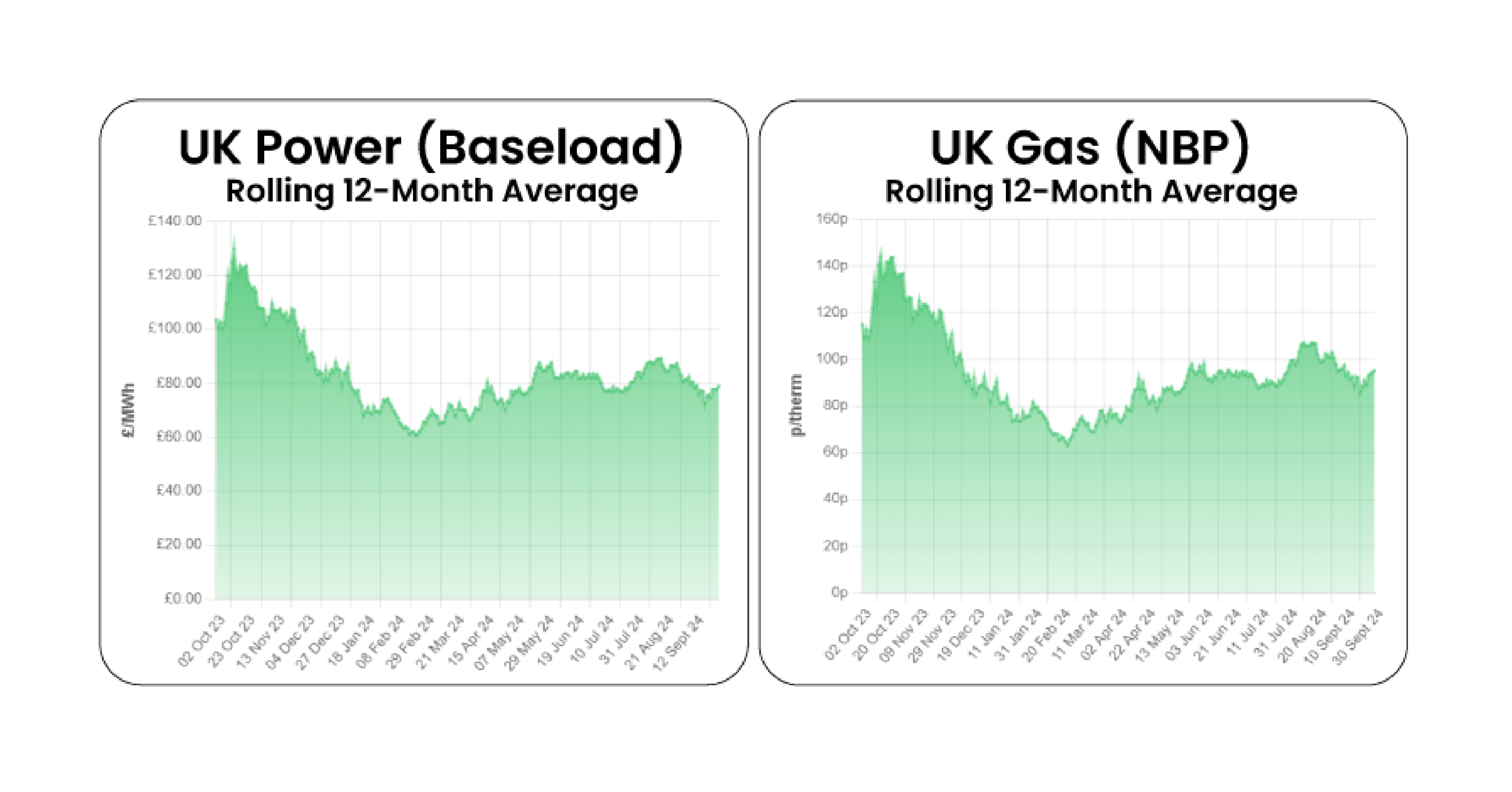

Gas

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

In the economic environment, equity markets have shown only a modest response to the tense geopolitical situation, with the FTSE 100 trading close to...

Equity markets have experienced a decline from their all-time highs at the beginning of the month due to concerns about the potential long-term...

Global equity markets responded positively to the Federal Reserve’s decision to cut interest rates by half a point in September. This move was...