UK Energy Market Analysis - August 2024

British consumer confidence has surged to its highest level in nearly three years as of August, driven by growing optimism around personal finances...

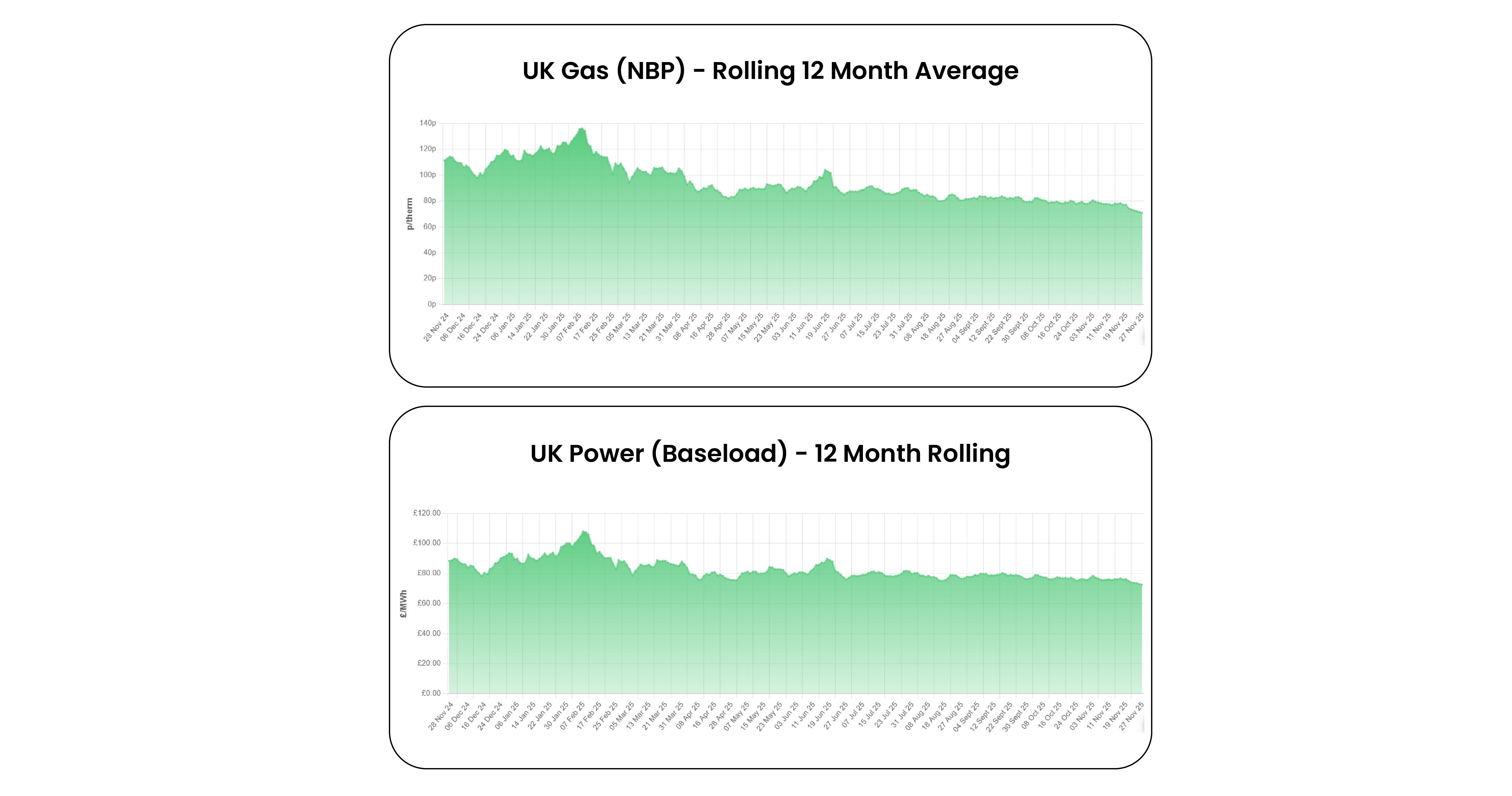

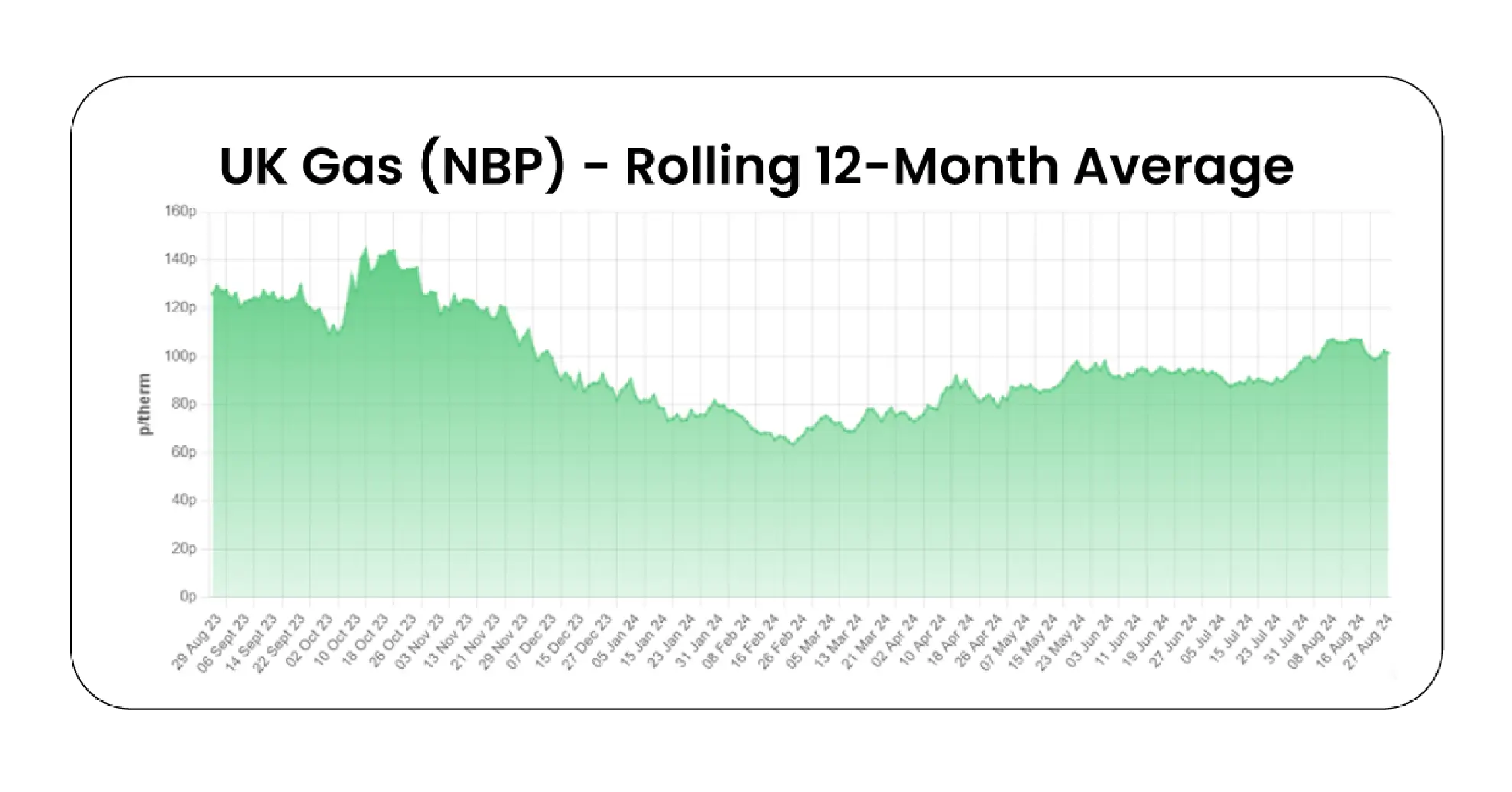

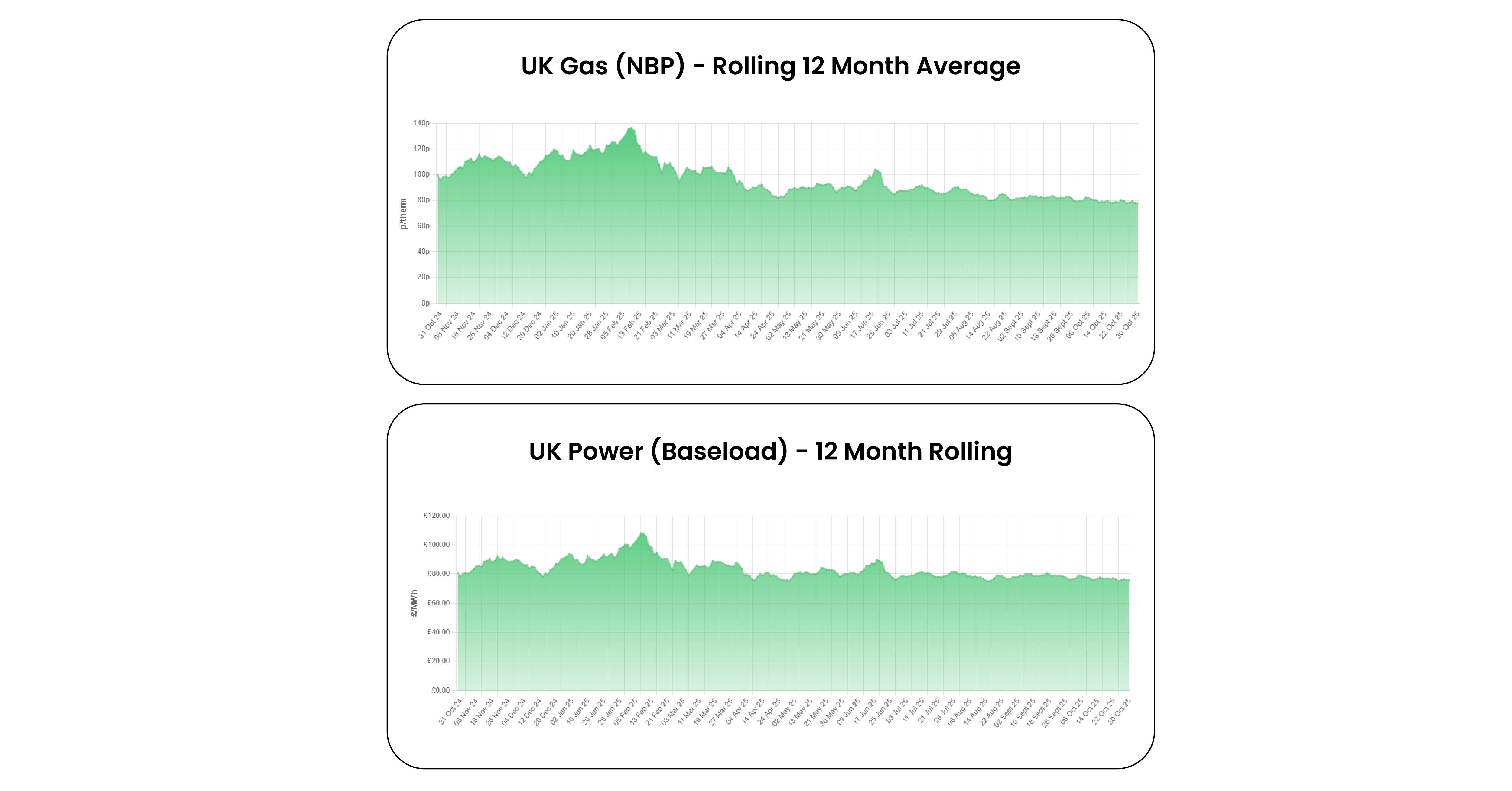

Despite very high gas demand and strong short-term power prices last week (with UK baseload clearing at £109.23/MWh for Tuesday delivery), prices for December and beyond have fallen sharply. Mild and windy forecasts from the weekend onward, together with hopes that ongoing peace talks could increase Russian energy exports, have reinforced an already bearish outlook driven by expectations of higher LNG supply in the coming months. Summer 26 gas, for instance, is down more than 5.00 ppt (7%) in a week, now trading at 67.50 ppt, an attractive buying opportunity given relatively low gas storage levels and the risk that peace negotiations may take longer than the market currently anticipates.

Economic Environment

Oil

Gas

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

British consumer confidence has surged to its highest level in nearly three years as of August, driven by growing optimism around personal finances...

Recently, warmer and windier-than-average weather has driven short-term prices lower. However, the absence of gas injections into European storage...

April has arrived with a mix of complexity and consequence for UK businesses managing energy and utility costs. It’s not just a question of whether...