How to Make Energy Procurement Decisions That Align with Your Net Zero Goals

Energy procurement is no longer just about securing the best price. It’s about striking the right balance between cost, carbon and complexity,...

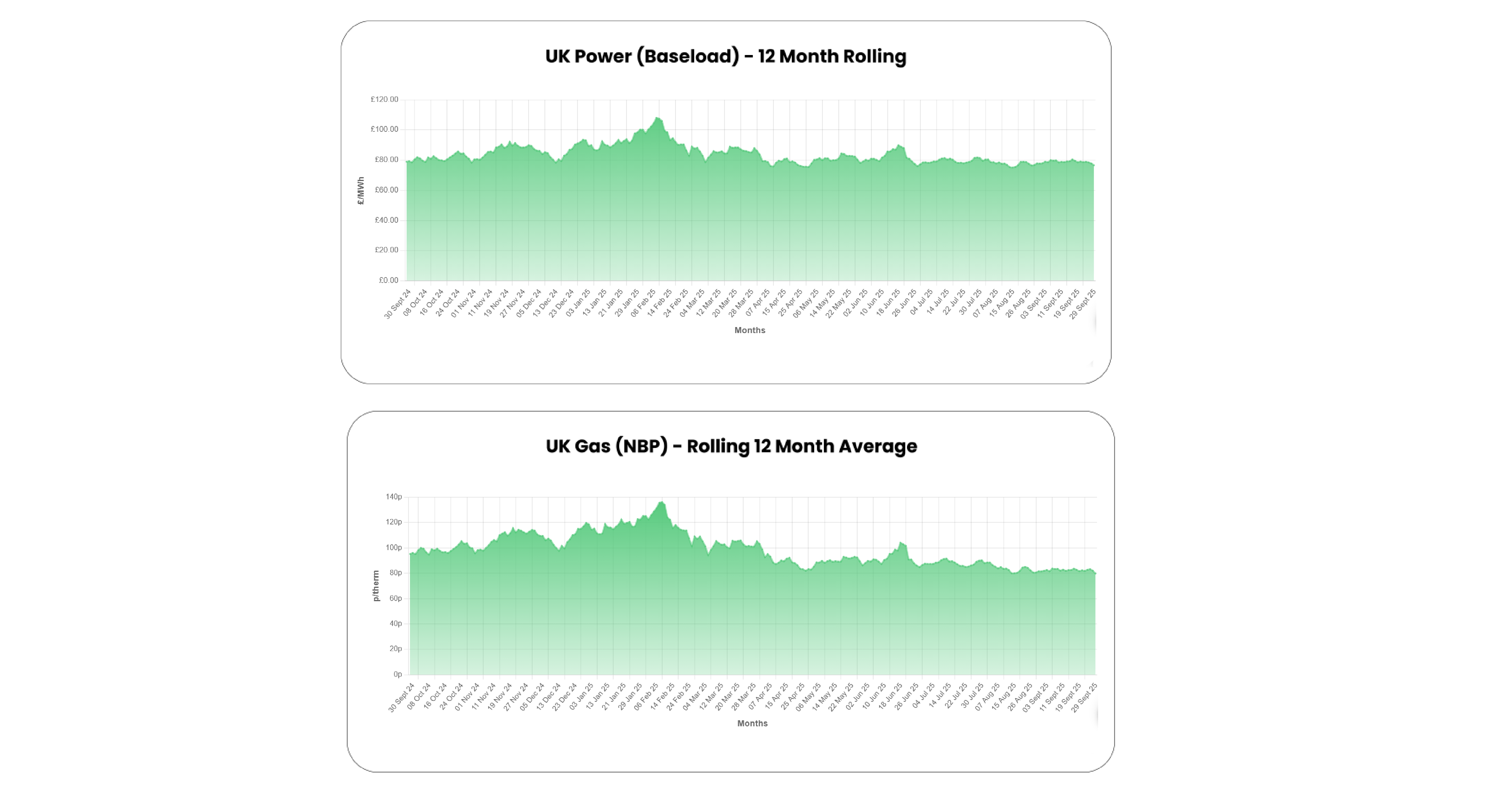

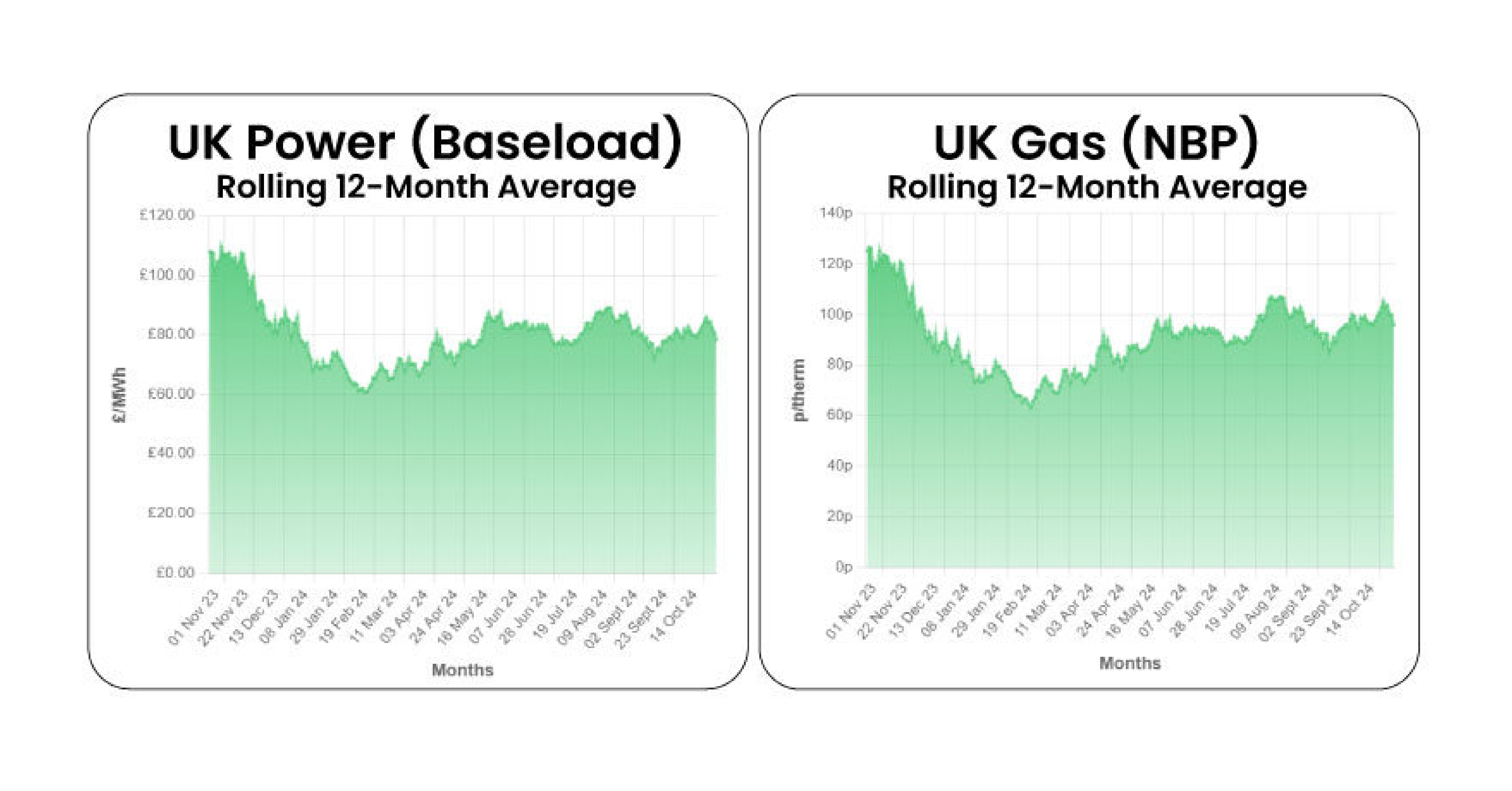

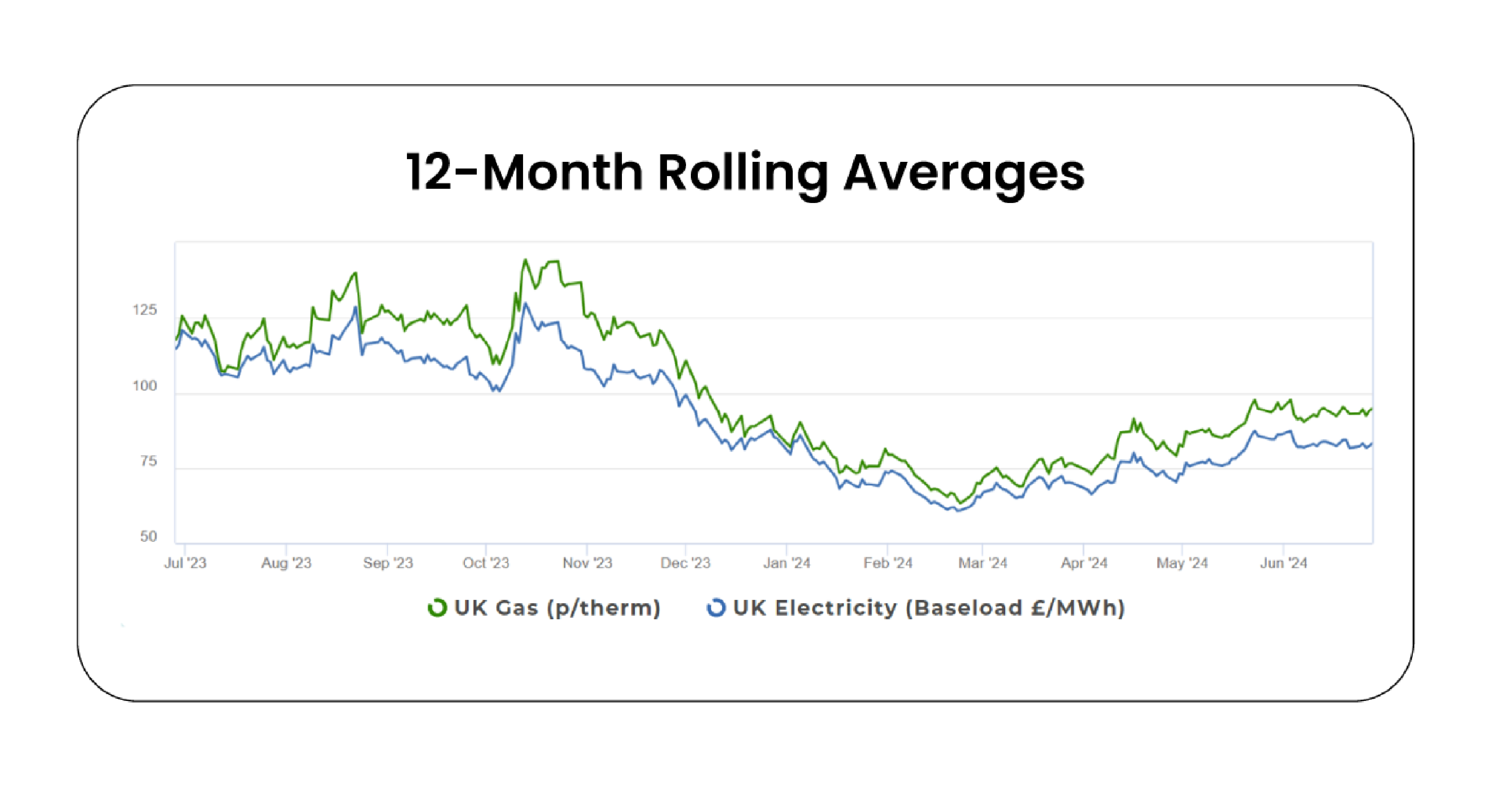

Large swings in wind generation and temperature throughout the month have driven equally volatile day-ahead prices on N2EX, ranging from £11.91/MWh to £93.50/MWh. Thankfully, and despite ongoing geopolitical uncertainty, long-term contracts have remained far more stable, with Winter 25 trading between £82.00/MWh and £85.00/MWh. Market expectations for both oil and gas now point to lower prices through 2026, supported by higher OPEC+ output and continued global LNG production growth. However, potential reductions in Russian exports due to stricter EU and US sanctions provide upside risk, as could a particularly cold winter, which could alter the current bearish outlook.

Economic Environment

Oil

Gas

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

Energy procurement is no longer just about securing the best price. It’s about striking the right balance between cost, carbon and complexity,...

Private-sector activity in the euro zone continued its downward trend for the second consecutive month in October, with declines primarily driven by...

Global tensions, underscored by the conflict in the Middle East and political events in France and across the Continent, have dominated global equity...