From Baku to Belém: A Round-Up of COP29 & What To Expect At COP30

COP 29: The ‘Finance COP’

Energy contracts can be deceptively simple on the surface. But dig a little deeper and what looks like a straightforward price per kilowatt-hour quickly turns into a tangled web of charges, levies and schemes that most procurement teams don’t get full visibility on until it’s too late.

As we move towards a future shaped more by policy and infrastructure costs than pure market pricing, understanding the hidden layers of your energy agreement is no longer a nice-to-have, it’s essential for protecting budgets and building resilient long-term strategies.

A Softening Market with Hidden Risks

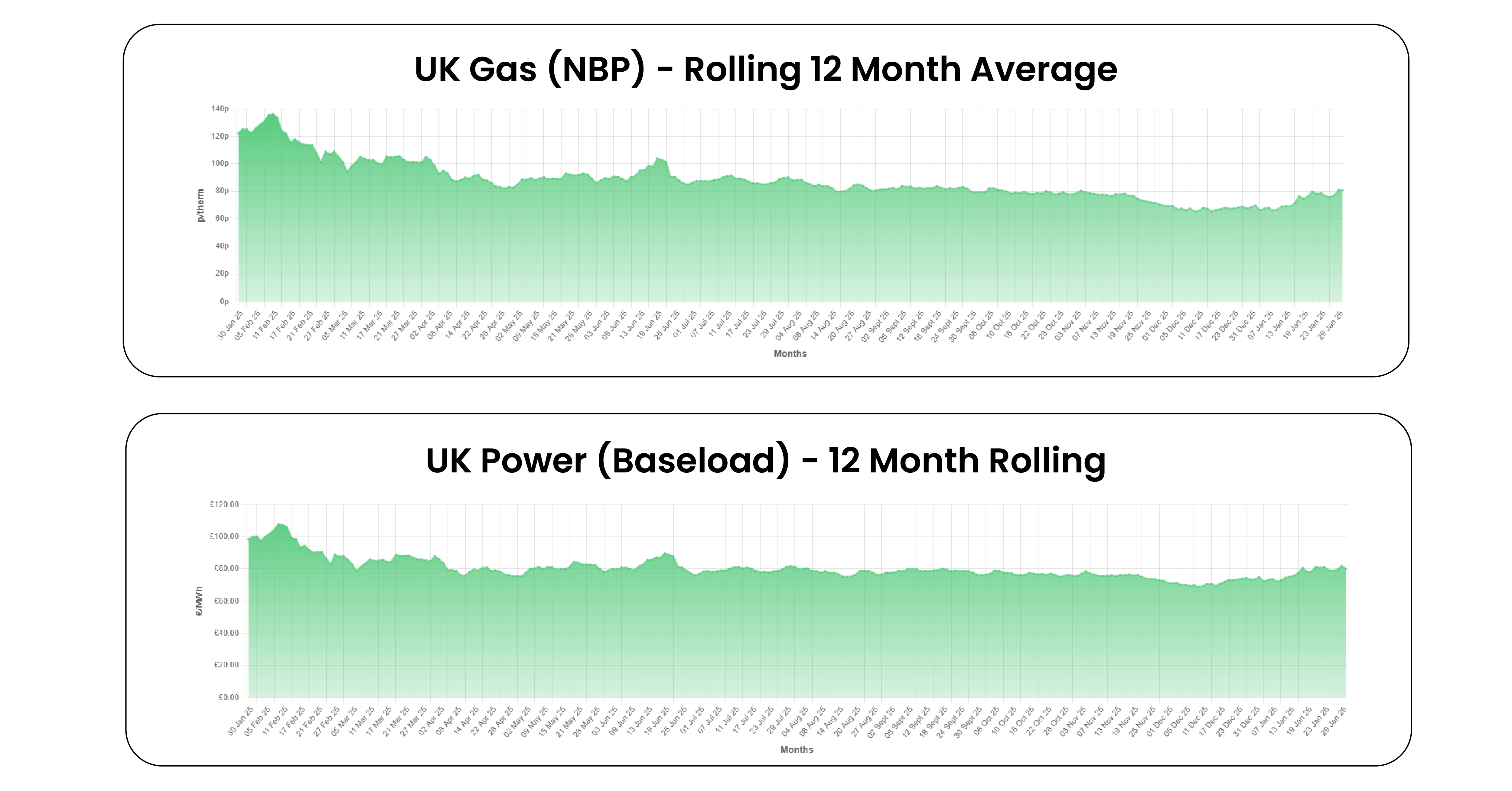

As we head into winter 2025, wholesale electricity prices have dropped to around £82/MWh, a 23% reduction since February. The reasons? Milder weather forecasts, steady global LNG supply and falling oil-linked generation costs.

However, procurement teams should be wary of assuming these price reductions equal cheaper energy bills. Wholesale costs now account for just 36% of the delivered electricity price, meaning over 60% comes from non-commodity charges.

Even as market conditions ease, these structural costs continue to rise and will dominate your contract over the next five years.

What’s Actually on Your Bill

For 2025–26, the average delivered electricity cost is estimated at £225.50/MWh. Here’s how it breaks down:

| Component | % of Total Cost |

| Wholesale (commodity) | 36% |

| Distribution (DUoS) | 15% |

| System balancing (BSUoS) | 6.5% |

| Renewables Obligation | 14.7% |

| Contracts for Difference | 3.7% |

| Capacity Market | 3.7% |

| Climate Change Levy | 1.7% |

| RAB & Industry Charges | 3.4% |

By 2027–28, this is projected to climb to around £250/MWh, largely due to increasing network and policy-related costs.

1. Nuclear RAB Levy

Since November 2025, the Nuclear Regulated Asset Base (RAB) levy has added about £3.46/MWh to business electricity bills. It’s forecasted to stay between £3.50–£4.50/MWh into 2026.

This cost helps fund new nuclear infrastructure, spreading the financial burden across all energy users. While predictable, it introduces a baseline uplift in energy costs, independent of market price movements.

2. TNUoS Transmission Charges

From 2026–27, Transmission Network Use of System (TNUoS) charges will rise steeply. For a standard low-voltage business, this could mean going from £2,500 to over £5,300/year, with potential increases to £9,000 by 2030–31.

This structural change, driven by Ofgem’s RIIO-ET3 framework, reflects the investment required to upgrade the grid to accommodate higher volumes of renewable generation.

3. Policy and Scheme Shifts

Several government and regulatory changes are now shaping business energy costs:

These changes offer some upside, but mostly for large industrial users. For most businesses, the trend points to higher structural charges over time.

4. Long-Term Schemes on the Horizon

Beyond 2027, new schemes like Carbon Capture Utilisation and Storage (CCUS), the Dispatchable Power Agreement (DPA), and the maturing BICS programme will reshape the market further.

These policies add complexity and potential opportunities for businesses who understand how to leverage them. They’ll also introduce new mechanisms for cost redistribution and investment risk-sharing across the supply chain.

The Market Outlook - What You Need To Know

Short-term (2025–26):

Medium-term (2026–27):

Long-term (2027+):

Strategic Response

The role of procurement is shifting. Energy contracts aren’t just a cost to be minimised, they’re a strategic lever for managing risk, ensuring compliance and enabling sustainable investment.

Here’s how to stay ahead:

Why This Matters and Why Now

The energy contract you sign today shapes your costs for years to come. But the market you're buying into is fundamentally different to what it was just a few years ago. It's more complex, more regulated and more volatile.

So, what’s at stake?

The organisations that get ahead of these changes will protect their margins, improve resilience and free up capital to invest in decarbonisation.

Those that don’t? They’ll be caught out by costs they never saw coming.

What to Do Next

At True Group, we’ve built the tools to help you see around corners and the team to help you act with confidence.

Let’s make your next energy decision one that strengthens your business for the long run.

COP 29: The ‘Finance COP’

Gas prices have been volatile in recent weeks, with the February contract reaching a high of 113.00 ppt in late January. The rally was driven by...

Chris Maclean is the CEO of True and Open Energy Market, and highlights several key issues raised by COP28.