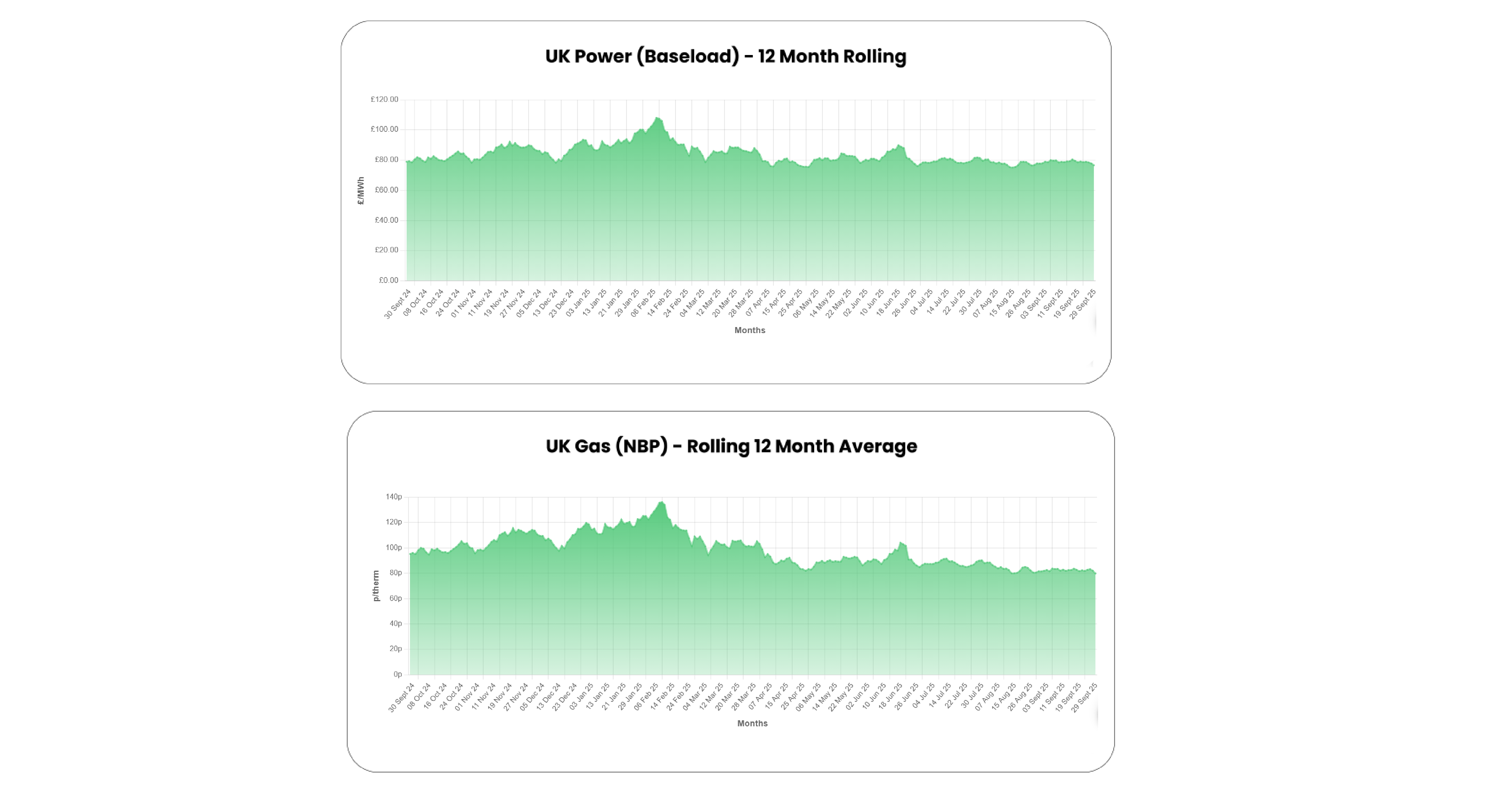

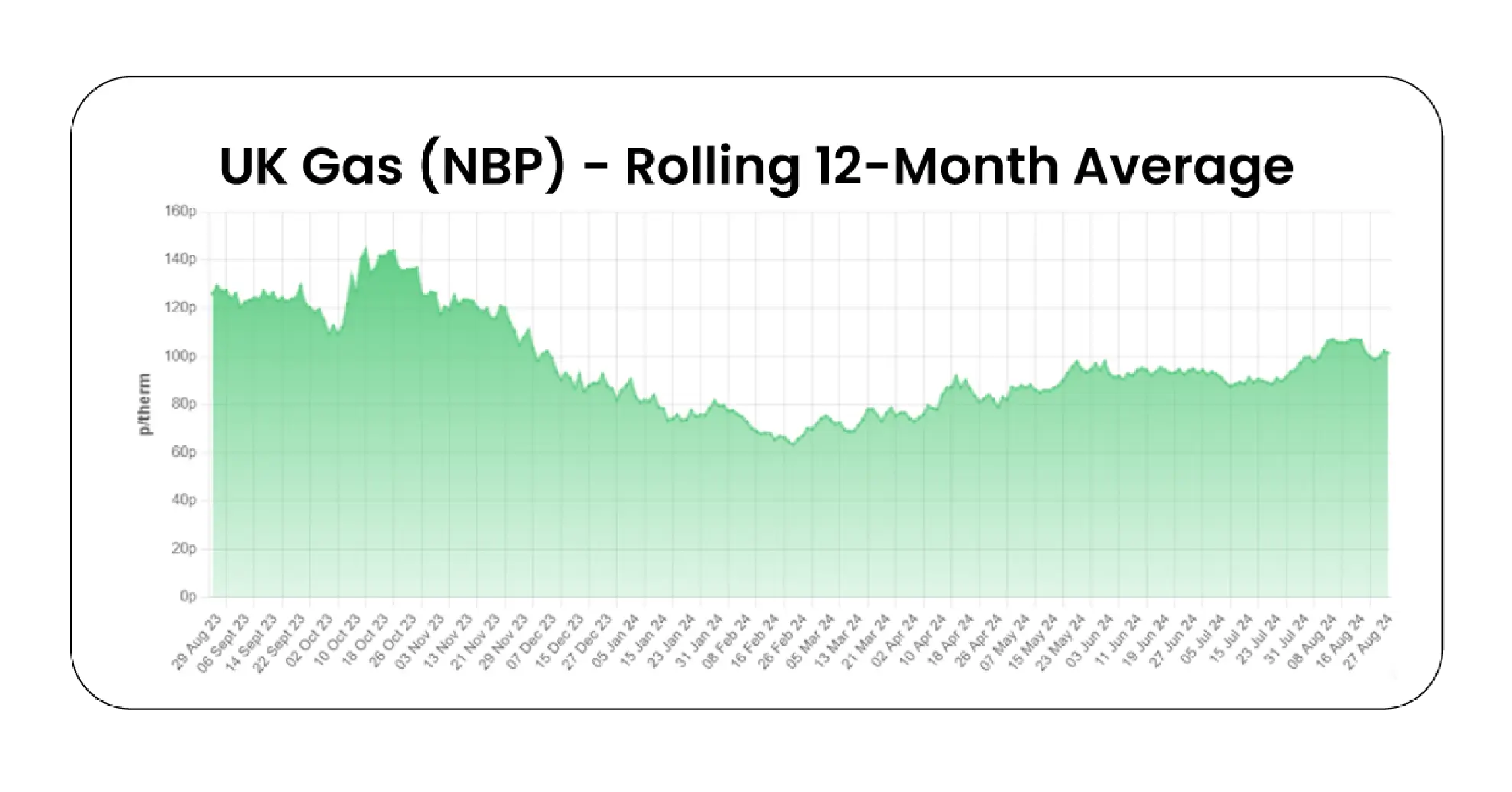

UK Energy Market Analysis - September 2025

Large swings in wind generation and temperature throughout the month have driven equally volatile day-ahead prices on N2EX, ranging from £11.91/MWh...

3 min read

![]() True Group

:

Dec 5, 2025 1:53:17 PM

True Group

:

Dec 5, 2025 1:53:17 PM

With rising non-commodity costs, volatile power markets, and increasing pressure to decarbonise, businesses are actively seeking ways to reduce their energy bills without compromising operations. One increasingly strategic option is Demand-Side Response (DSR), where organisations flex their electricity usage in response to system signals, price incentives, or market opportunities.

By engaging in DSR, businesses can not only cut costs but also generate revenue, improve grid resilience and optimise the use of on-site generation or storage assets.

What is Demand-Side Response?

Demand-Side Response enables businesses to adjust their electricity demand in real-time in response to changes in market price or system requirements. Instead of passively consuming power, organisations become active participants in the energy market, turning operational flexibility into financial gain and competitive advantage.

There are multiple forms of DSR, ranging from automated response to pricing signals to formal participation in grid-balancing and trading markets. The opportunity set is broad and growing.

Key DSR Opportunities for Businesses

1. Wholesale Trading Optimisation

Businesses on pass-through or flexible supply contracts can optimise their usage around day-ahead and intraday wholesale market prices. By shifting consumption to low-price periods or avoiding price spikes, especially during high system stress or intermittent renewable output, organisations can materially reduce energy costs.

Increasingly, larger businesses (or aggregators acting on their behalf) participate directly in wholesale markets by:

This strategy is particularly powerful when combined with battery storage or dispatchable on-site generation.

2. Balancing Mechanism Participation

The Balancing Mechanism (BM) is National Grid ESO’s primary tool for fine-tuning supply and demand in near real-time. Historically dominated by generators, recent reforms have opened the BM to demand-side participants, allowing large consumers to be paid to reduce demand when the system needs support.

Benefits include:

Eligibility depends on metering, response speed, and dispatchability, but many energy-intensive sites now see BM participation as a key revenue stream.

3. Reserve Services

Reserve services are used by National Grid to ensure there’s backup capacity available to deal with unforeseen fluctuations in demand or generation loss. Demand-side participants can provide Short-Term Operating Reserve (STOR) or other reserve products by committing to reduce load on short notice.

How it works:

Participation requires the ability to deliver consistent, measurable response, often enabled via automation or aggregator platforms.

4. Frequency Response Services

Frequency response is critical to maintaining system stability. When supply and demand deviate, the system frequency drifts and needs to be corrected instantly. Businesses with ultra-fast response capability (often via battery storage) can participate in services such as:

These services offer premium revenue for ultra-rapid response (sub-second to 1-second) and are increasingly competitive due to growing battery deployment. However, fast-acting flexible demand (such as chillers, HVAC, or pumps) can also qualify.

5. Capacity Market Revenue

The Capacity Market ensures there’s enough available capacity on the system during peak demand periods. Businesses can bid their flexible demand or behind-the-meter generation into auctions and receive capacity payments in return for agreeing to curtail or switch generation on during stress events.

There are two types of opportunities:

This market rewards availability more than actual usage and is suited to businesses with consistent, predictable flexibility.

6. On-site Arbitrage (Site Arbitrage)

Many businesses now operate hybrid energy systems including on-site generation (e.g. solar PV, CHP), EV chargers and battery energy storage. DSR strategies enable site-level arbitrage, where:

This holistic approach optimises all site assets and can be fully automated through Energy Management Systems (EMS) or control platforms.

Additional Cost-Saving Opportunities

7. Reducing Peak-Time Network Charges

DSR can help businesses avoid costly grid charges, including:

Reducing demand at specific times can lower overall bills even without formal DSR market participation.

Is Your Business a Good Fit?

You may benefit from DSR if your business has:

Industries such as manufacturing, cold storage, water utilities, chemicals, and commercial estates are often ideal candidates.

Demand-Side Response is now a core part of modern energy cost management. Whether through wholesale price avoidance, grid services, or on-site optimisation, DSR offers tangible benefits to businesses looking to reduce costs, build resilience and participate in the low-carbon transition.

If you’re not yet exploring these mechanisms, you’re likely leaving money on the table and missing out on strategic flexibility in an increasingly dynamic energy market.

Speak to our team today about how you could implement DSR into your strategy.

Large swings in wind generation and temperature throughout the month have driven equally volatile day-ahead prices on N2EX, ranging from £11.91/MWh...

Labour’s recent U-turn on green investment is disappointing but not unexpected. With the general election less than a year away, this does nothing to...

British consumer confidence has surged to its highest level in nearly three years as of August, driven by growing optimism around personal finances...