UK Energy Market Analysis - April 2025

Weaker global demand and strong supply fundamentals continue to weigh on energy markets, offering fresh hedging opportunities.April was marked by...

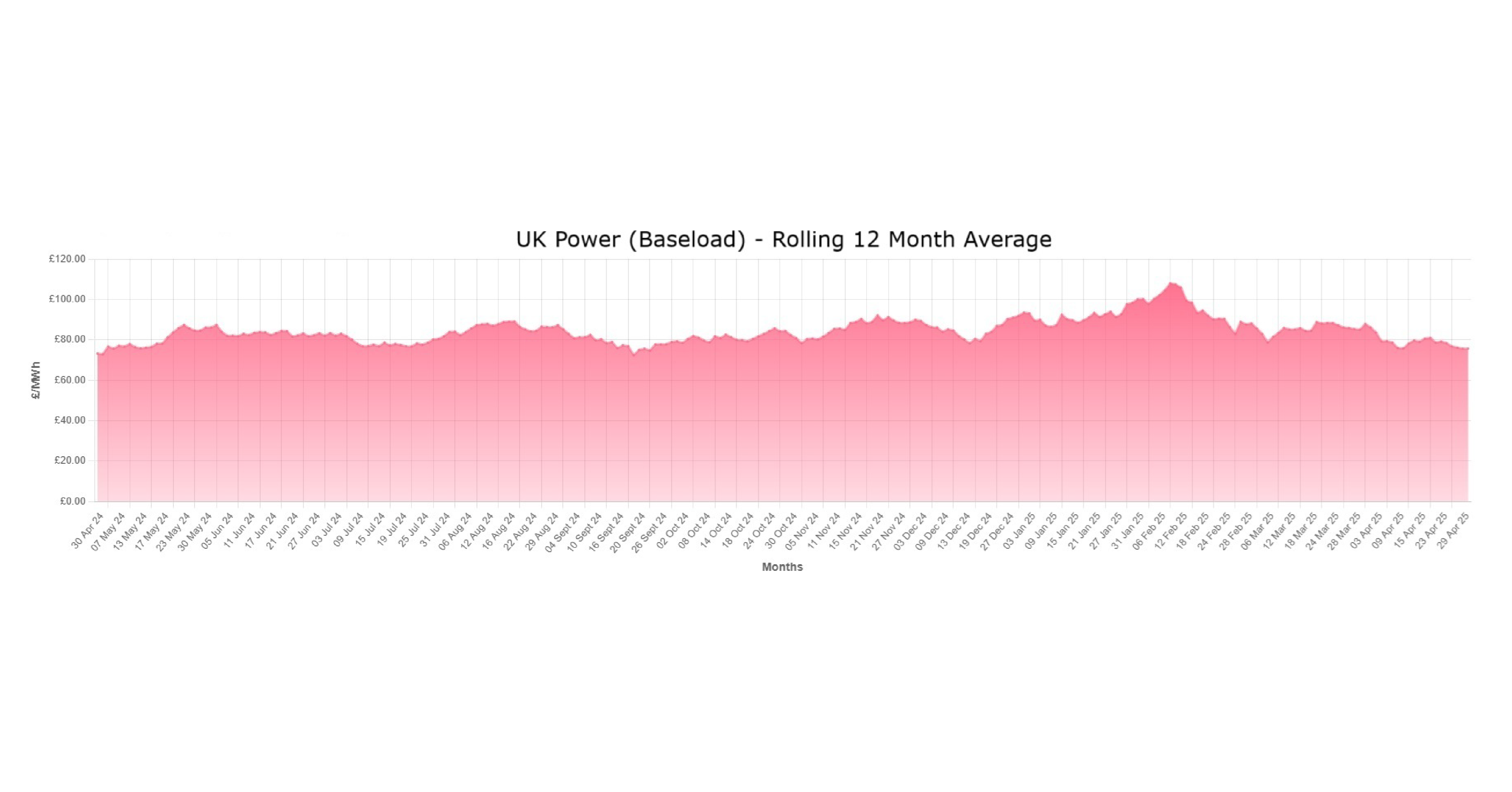

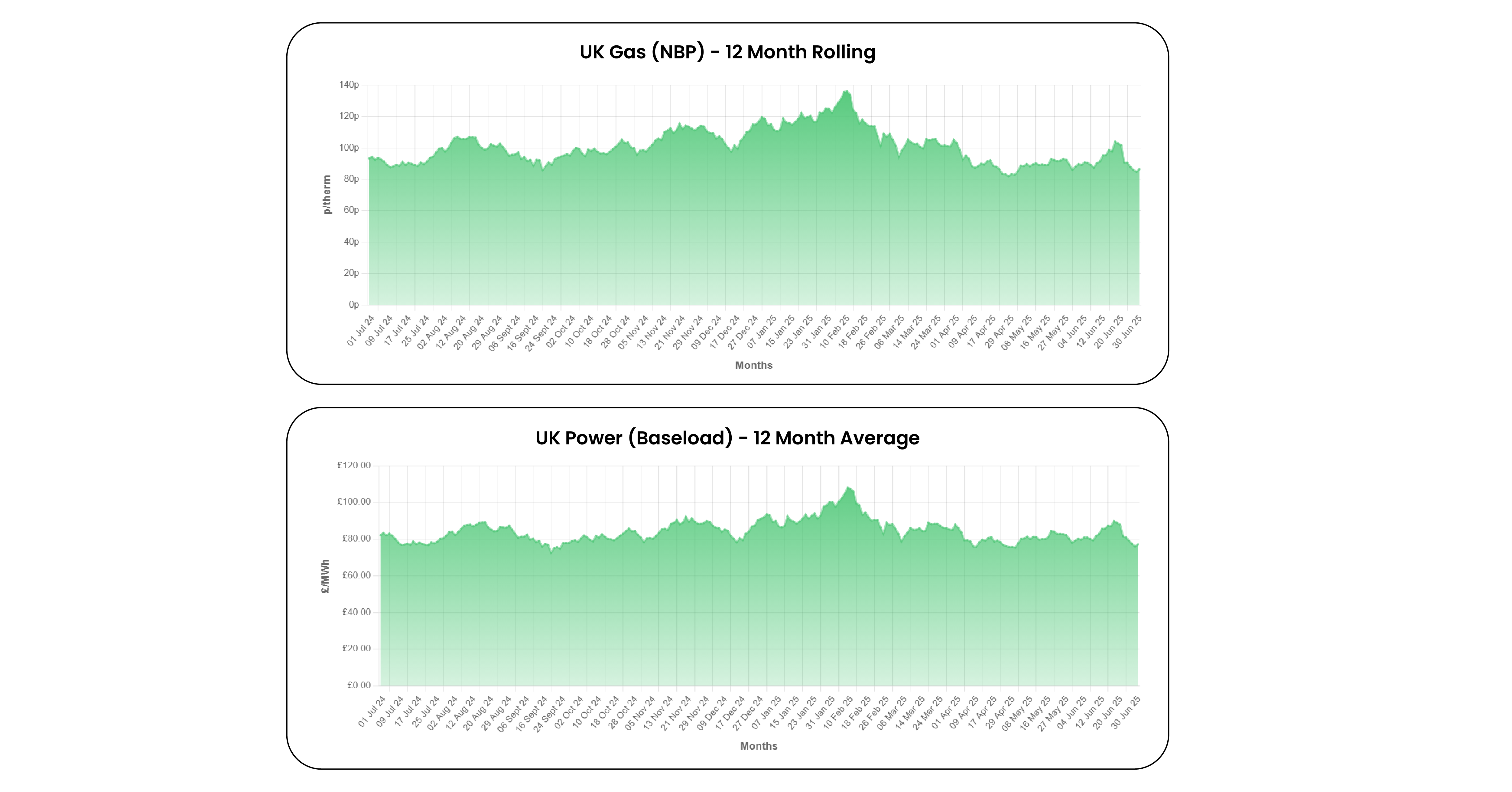

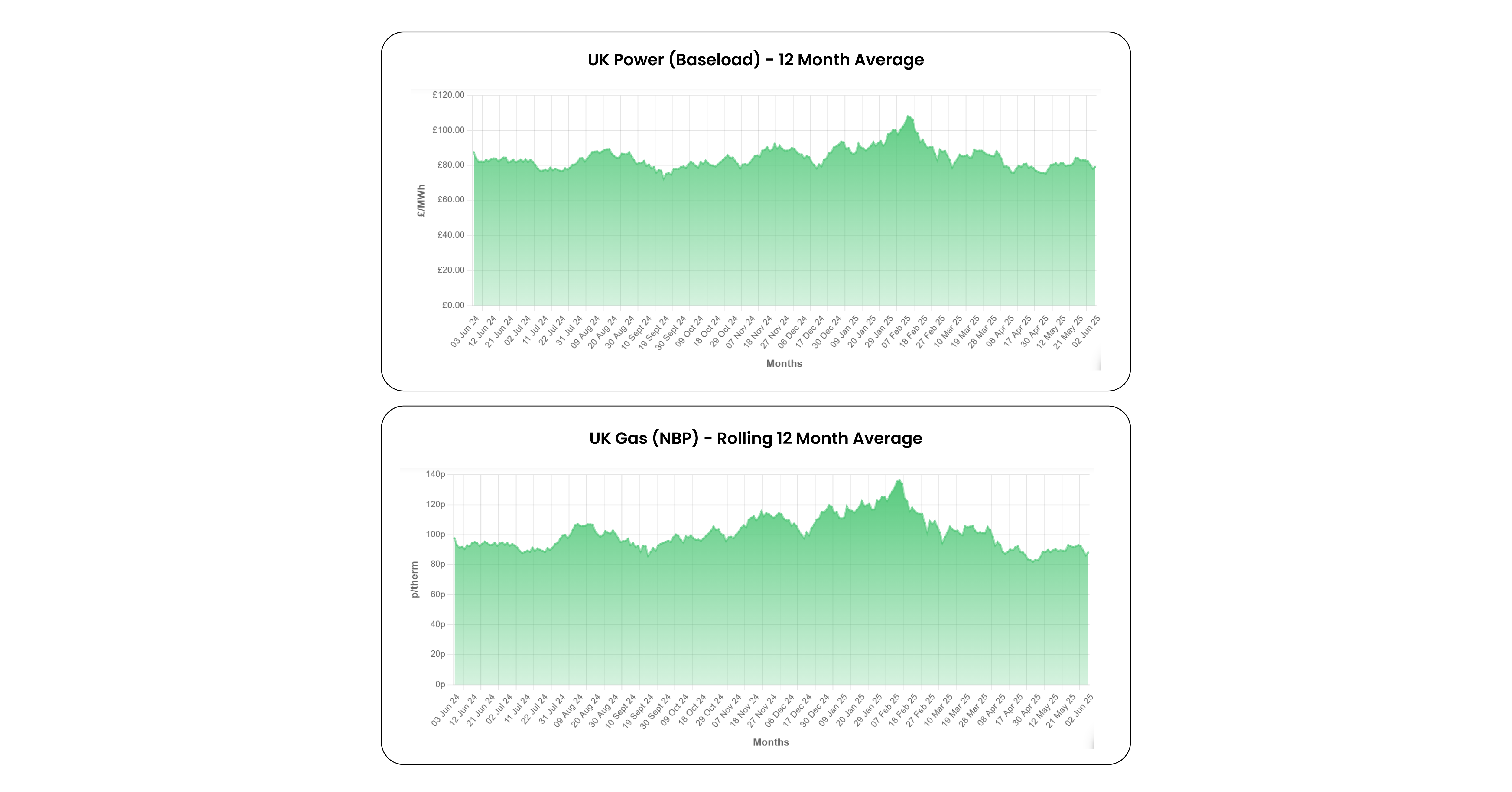

Weak wind and solar output across Europe has supported short-term power prices lately, with German spot averaging €90/MWh and the UK £86/MWh on N2EX last week. Looking ahead, temperatures are expected to remain near seasonal norms, wind generation is forecast to improve in the coming days, and nuclear availability is set to rise. Long-term prices have eased through August, driven by ample LNG supply and continued storage injections, as market attention now turns to key Norwegian gas maintenance amid a lull in geopolitical developments. While delays to Norwegian maintenance and potential US sanctions on Russia pose near-term upside risks, the broader outlook remains bearish due to higher OPEC+ output and ongoing global LNG growth.

Economic Environment

Oil

Gas

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

Weaker global demand and strong supply fundamentals continue to weigh on energy markets, offering fresh hedging opportunities.April was marked by...

Strong renewable output, combined with low demand (driven by mild weather and extended weekends across much of continental Europe) has put downward...

It has been a volatile month in energy markets, with sharp movements in oil and gas prices driven by the rapidly evolving situation in the Middle...