UK Energy Market Analysis - April 2025

Weaker global demand and strong supply fundamentals continue to weigh on energy markets, offering fresh hedging opportunities.April was marked by...

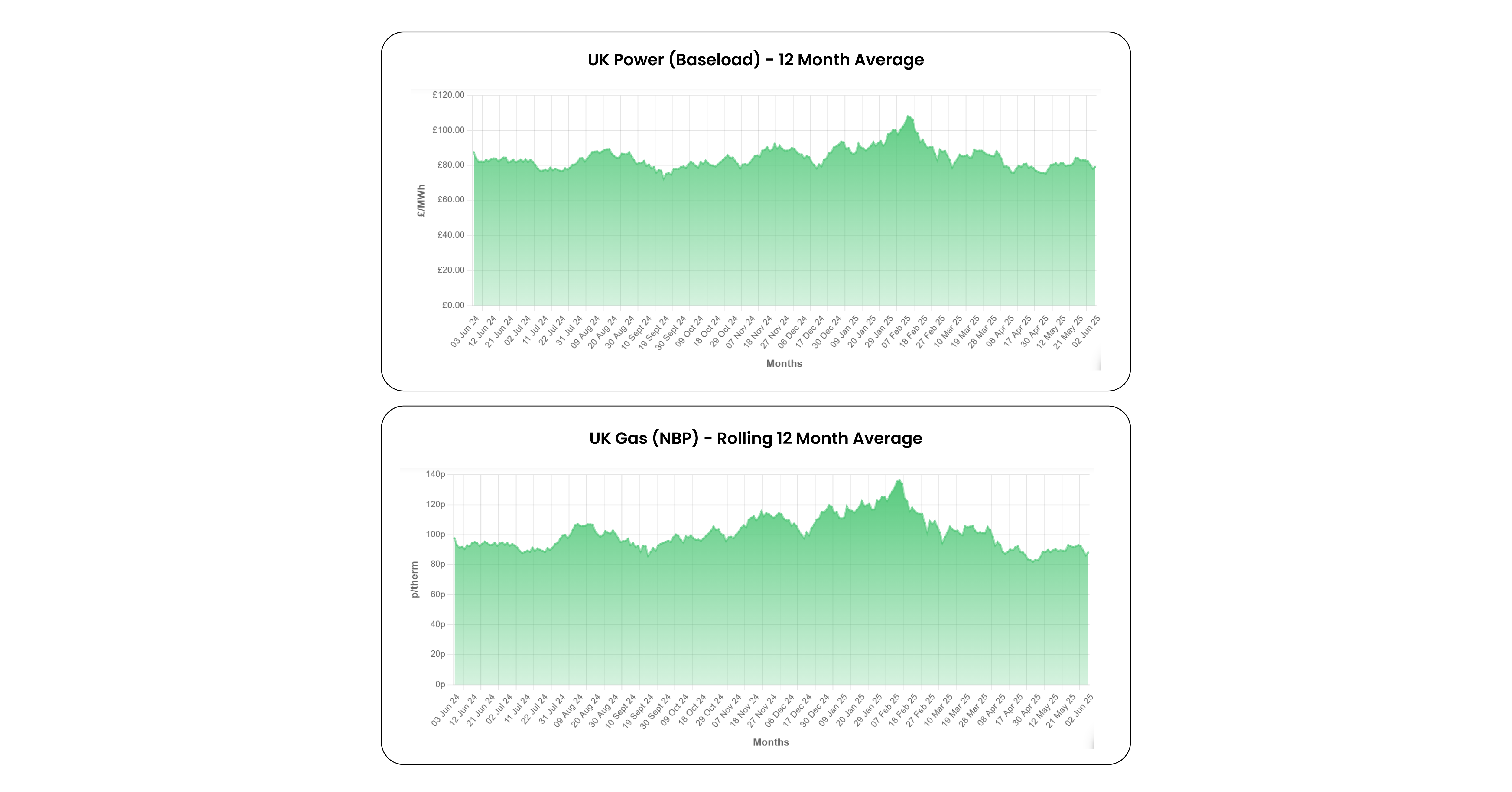

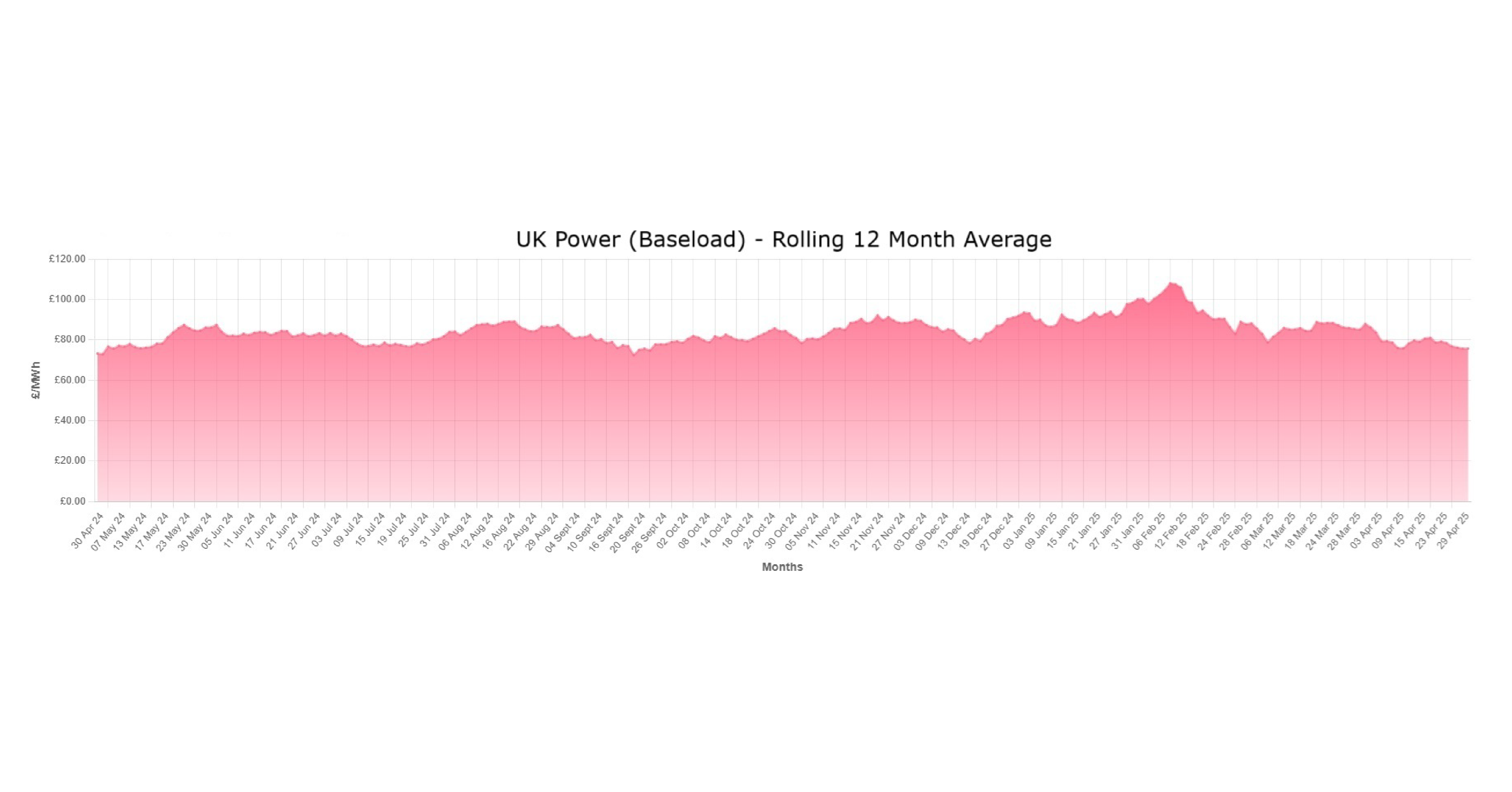

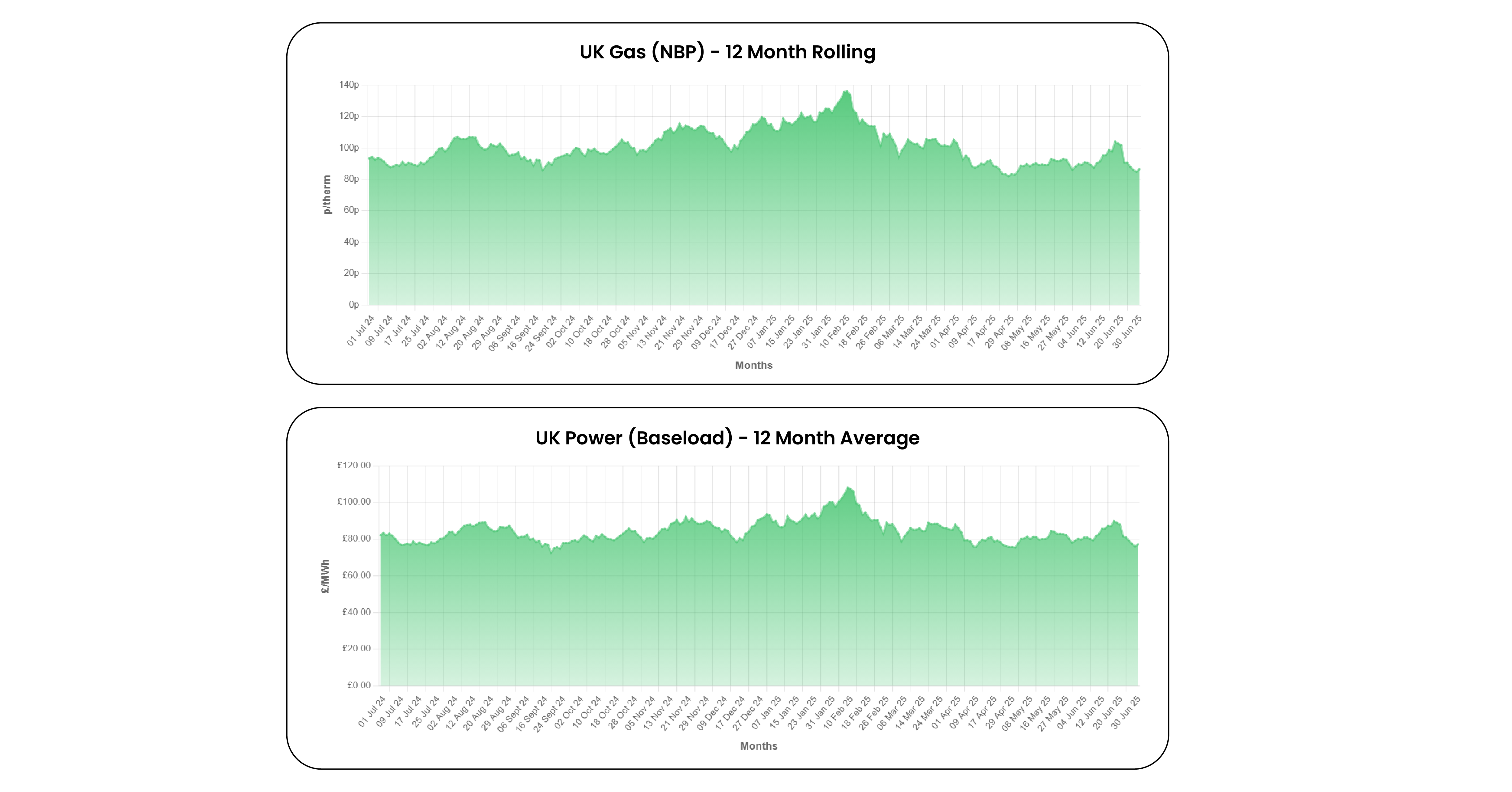

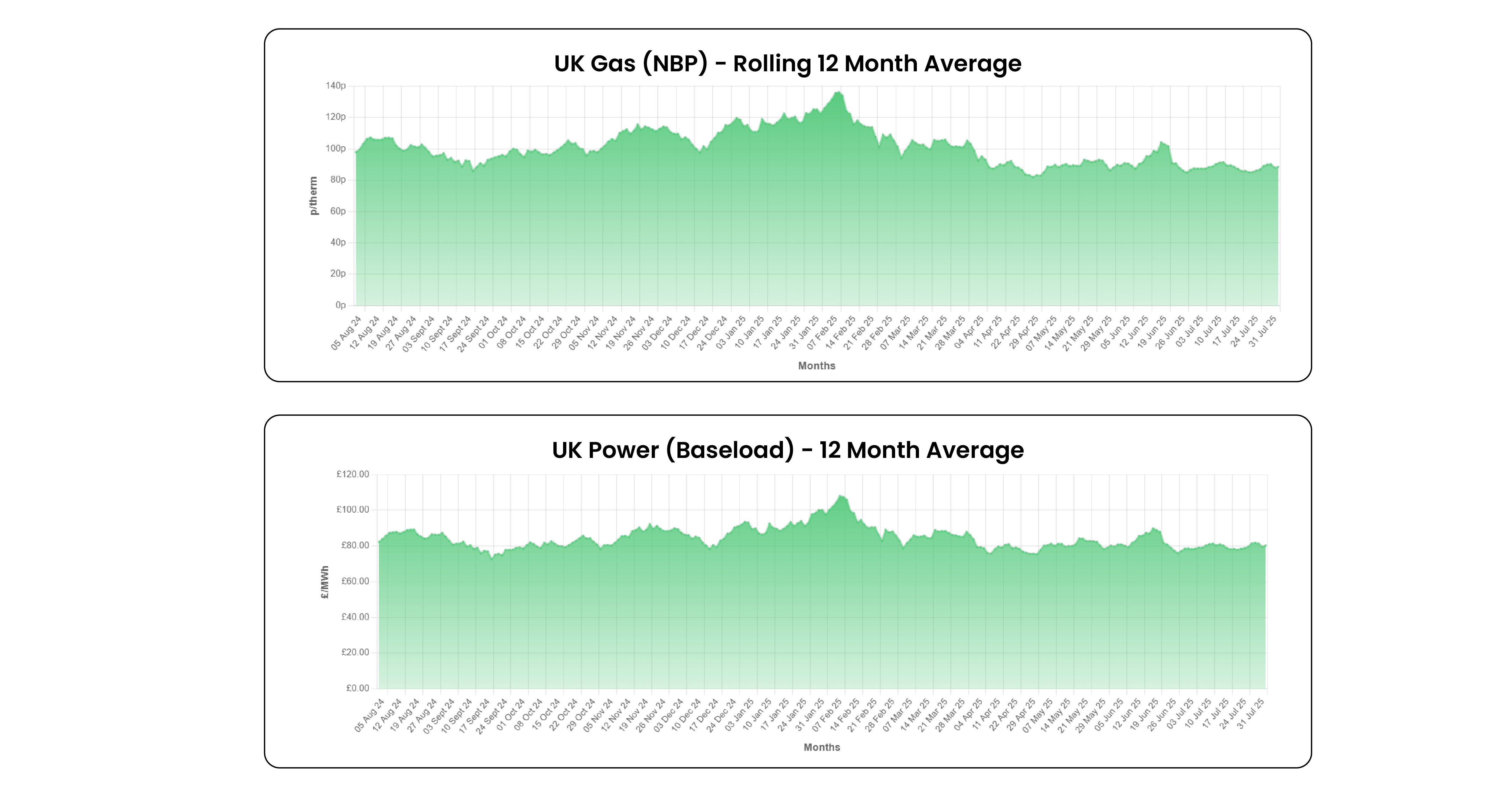

It has been a volatile month in energy markets, with sharp movements in oil and gas prices driven by the rapidly evolving situation in the Middle East. A shutdown of the Strait of Hormuz now appears unlikely, and the risk premium that had built up in forward contracts has quickly disappeared. Meanwhile, the ongoing heatwave has pushed short-term power prices up, especially on the continent, with day-ahead baseload clearing above €100.00/MWh on several occasions. Looking ahead, assuming stable exports from the Middle East, long-term contracts are expected to continue falling in the coming weeks, thanks to a weakening US dollar, the anticipated impact of trade tariffs, and rising global LNG supply.

Economic Environment

Oil

Gas

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

Weaker global demand and strong supply fundamentals continue to weigh on energy markets, offering fresh hedging opportunities.April was marked by...

Strong renewable output, combined with low demand (driven by mild weather and extended weekends across much of continental Europe) has put downward...

1 min read

Despite bearish short-term fundamentals, gas and power prices have risen lately due to several factors. First, weather forecasts point to another...