UK Energy Market Analysis - November 2025

Despite very high gas demand and strong short-term power prices last week (with UK baseload clearing at £109.23/MWh for Tuesday delivery), prices for...

European power grids have come under significant pressure lately, as weather-driven demand surged across the region. Prices climbed to an 11-month high in the UK for Thursday delivery (£121.39/MWh for baseload on N2EX) and cleared at €154.12/MWh in Germany. However, despite these supportive fundamentals, long-dated gas contracts are trading slightly below pre-holiday levels. This divergence highlights the scale of the expected increase in global LNG supply and reflects market confidence that storage sites will be comfortably replenished over the spring and summer. This outlook should hold, barring any geopolitical disruptions or unexpected supply outages.

Economic Environment

Oil

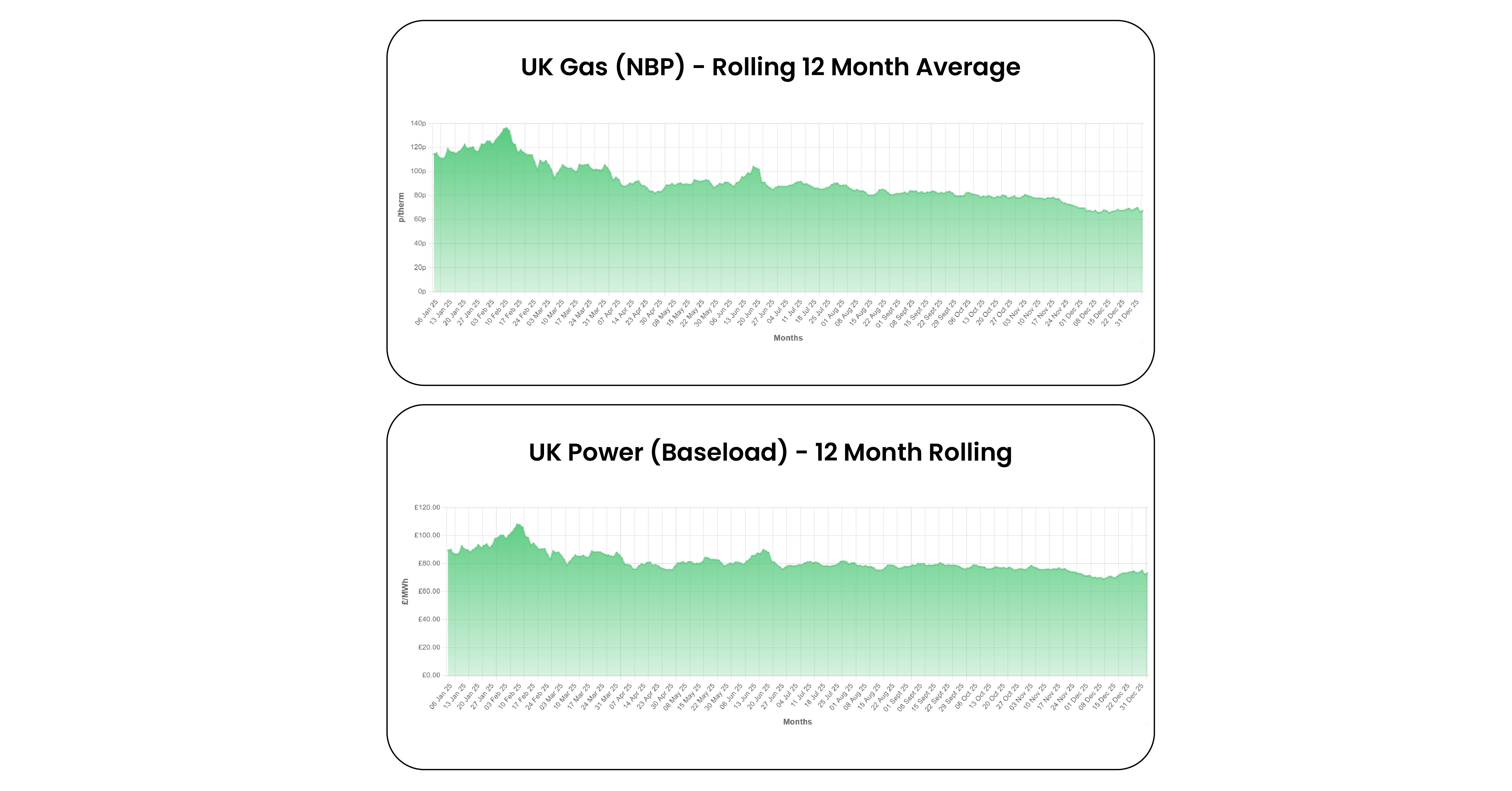

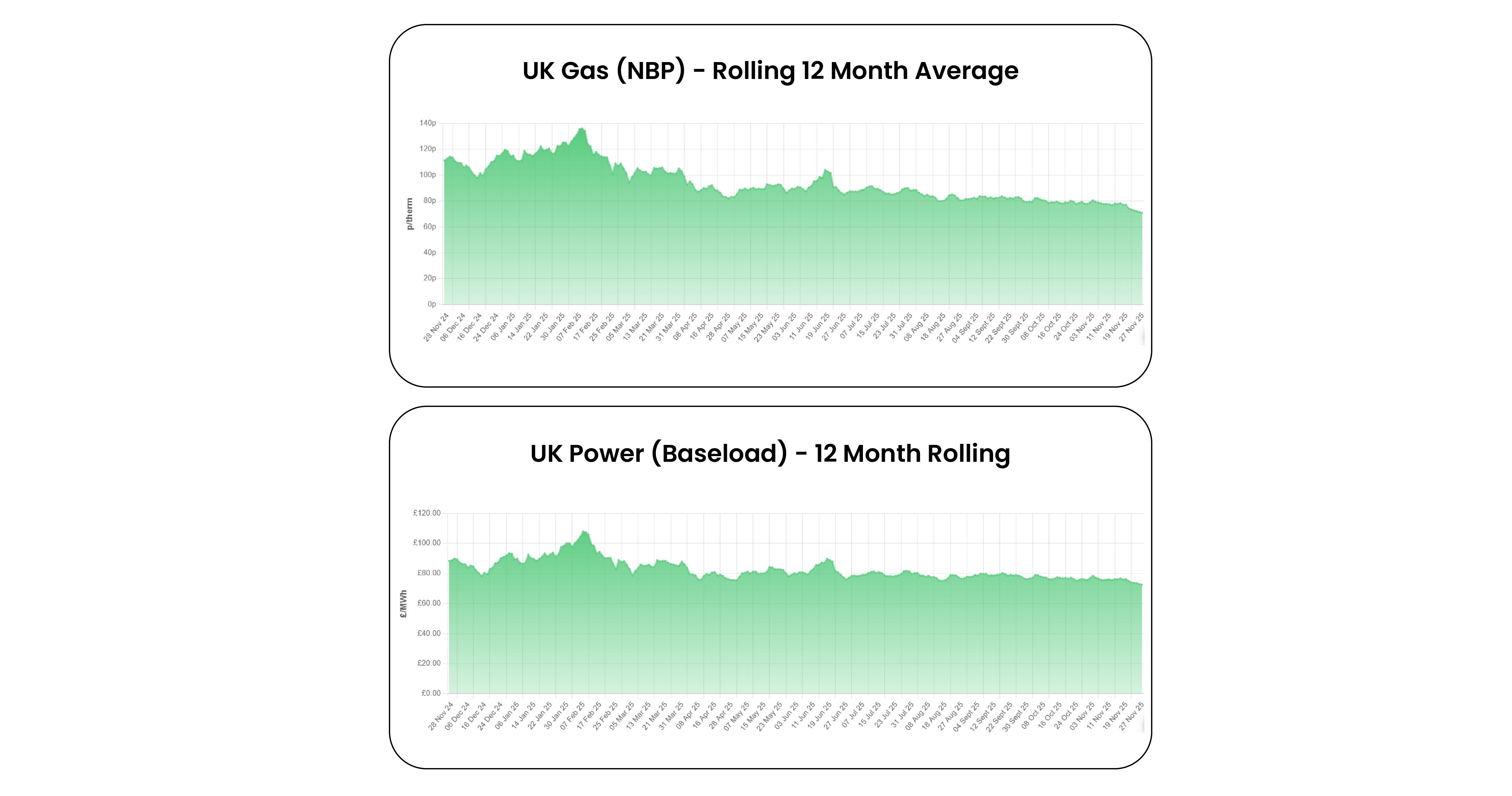

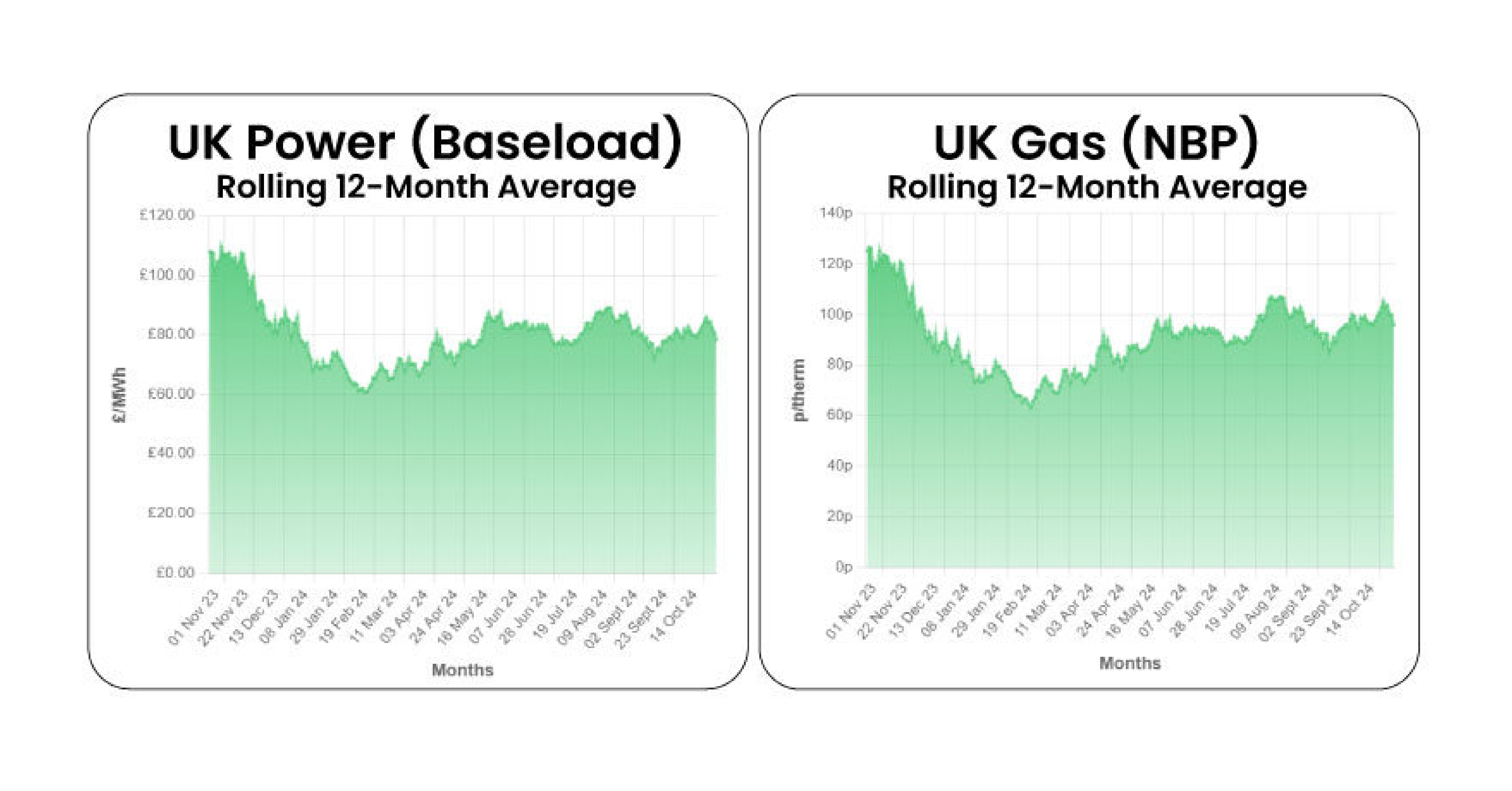

Gas

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

Despite very high gas demand and strong short-term power prices last week (with UK baseload clearing at £109.23/MWh for Tuesday delivery), prices for...

1 min read

The renewable energy sector is no longer a niche experiment, it’s a global economic force reshaping how we power our lives. The next five years will...

Private-sector activity in the euro zone continued its downward trend for the second consecutive month in October, with declines primarily driven by...