UK Energy Market Analysis - April 2025

Weaker global demand and strong supply fundamentals continue to weigh on energy markets, offering fresh hedging opportunities.April was marked by...

Despite bearish short-term fundamentals, gas and power prices have risen lately due to several factors. First, weather forecasts point to another heatwave across Northwestern Europe, accompanied by low wind generation. Second, a sharp rebound in the US dollar against the euro and sterling has pushed up the price of LNG, coal, and oil products. Third—and potentially a major market driver—the threat of increased US tariffs and penalties on Russian energy buyers has resurfaced. On Monday, Mr. Trump said Russia had “10 or 12 days” to agree to a ceasefire in Ukraine or face tariffs, along with its oil buyers. It remains to be seen whether this rhetoric will impact Russian oil exports and, crucially for European gas prices, whether it will affect Russian pipeline gas or LNG flows. Assuming any disruption proves short-lived, prices should decrease in the coming weeks, as the underlying fundamentals remain bearish due to rising OPEC+ oil output and the continued increase in global LNG production.

Economic Environment

Oil

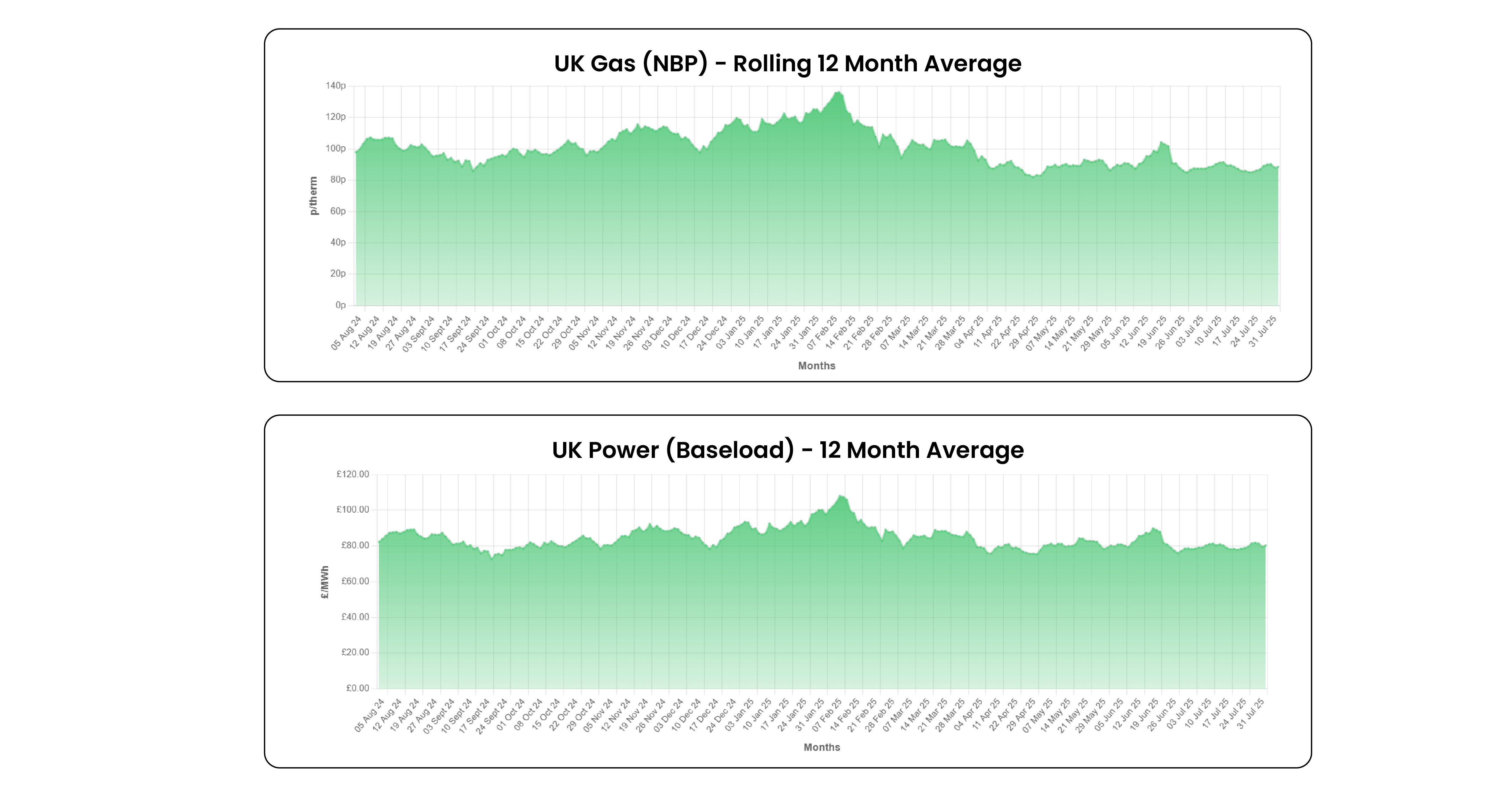

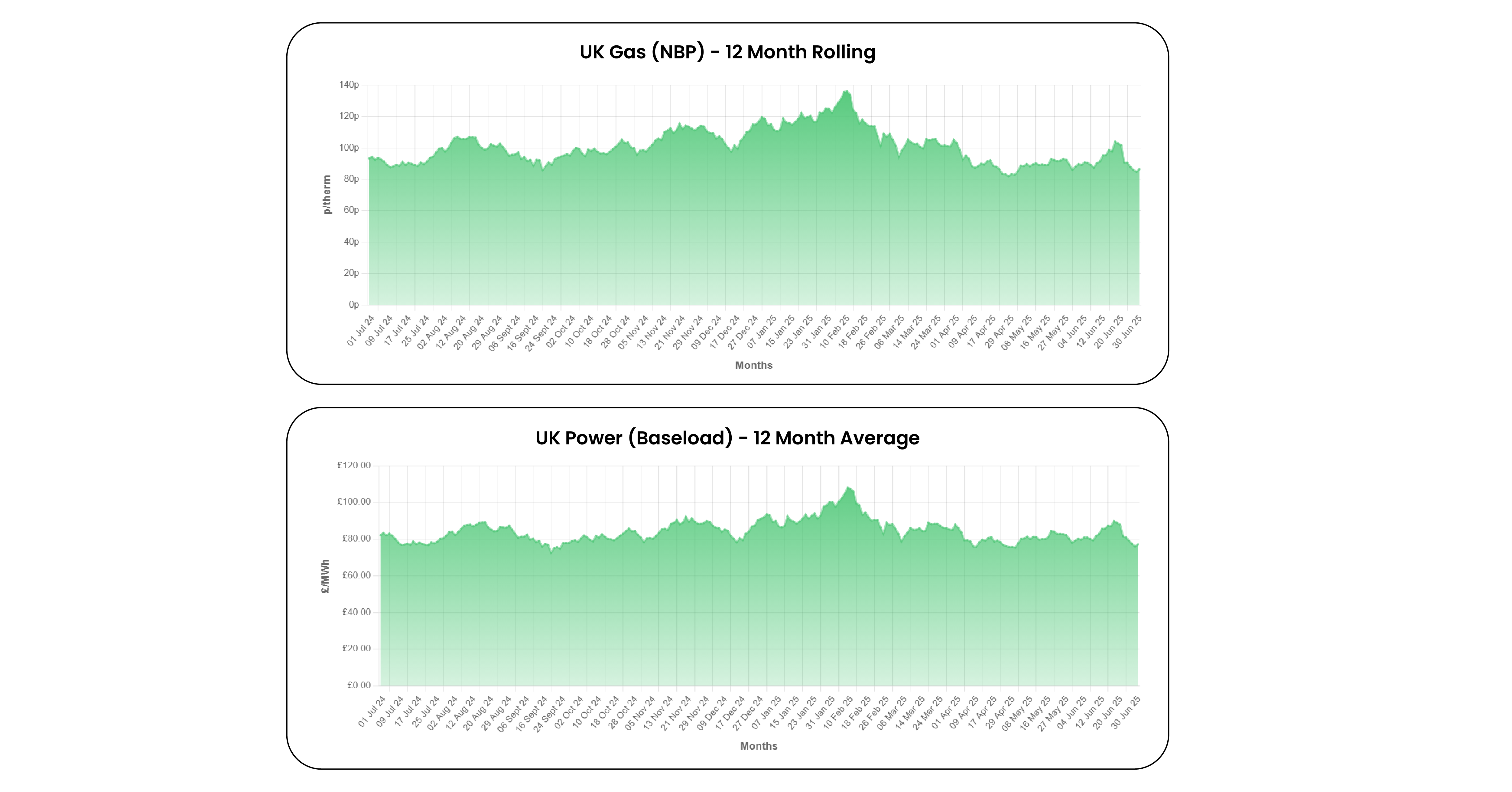

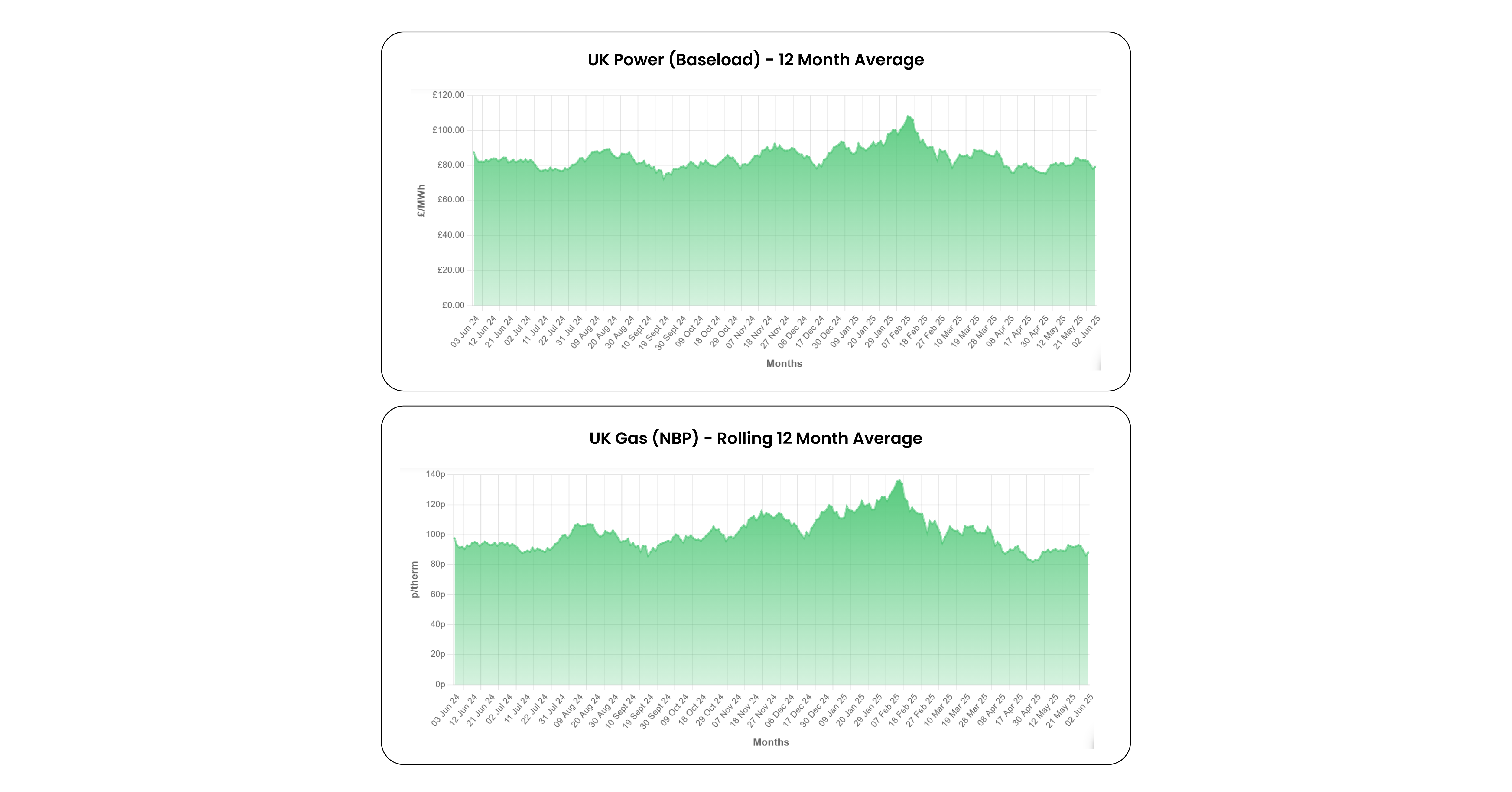

Gas

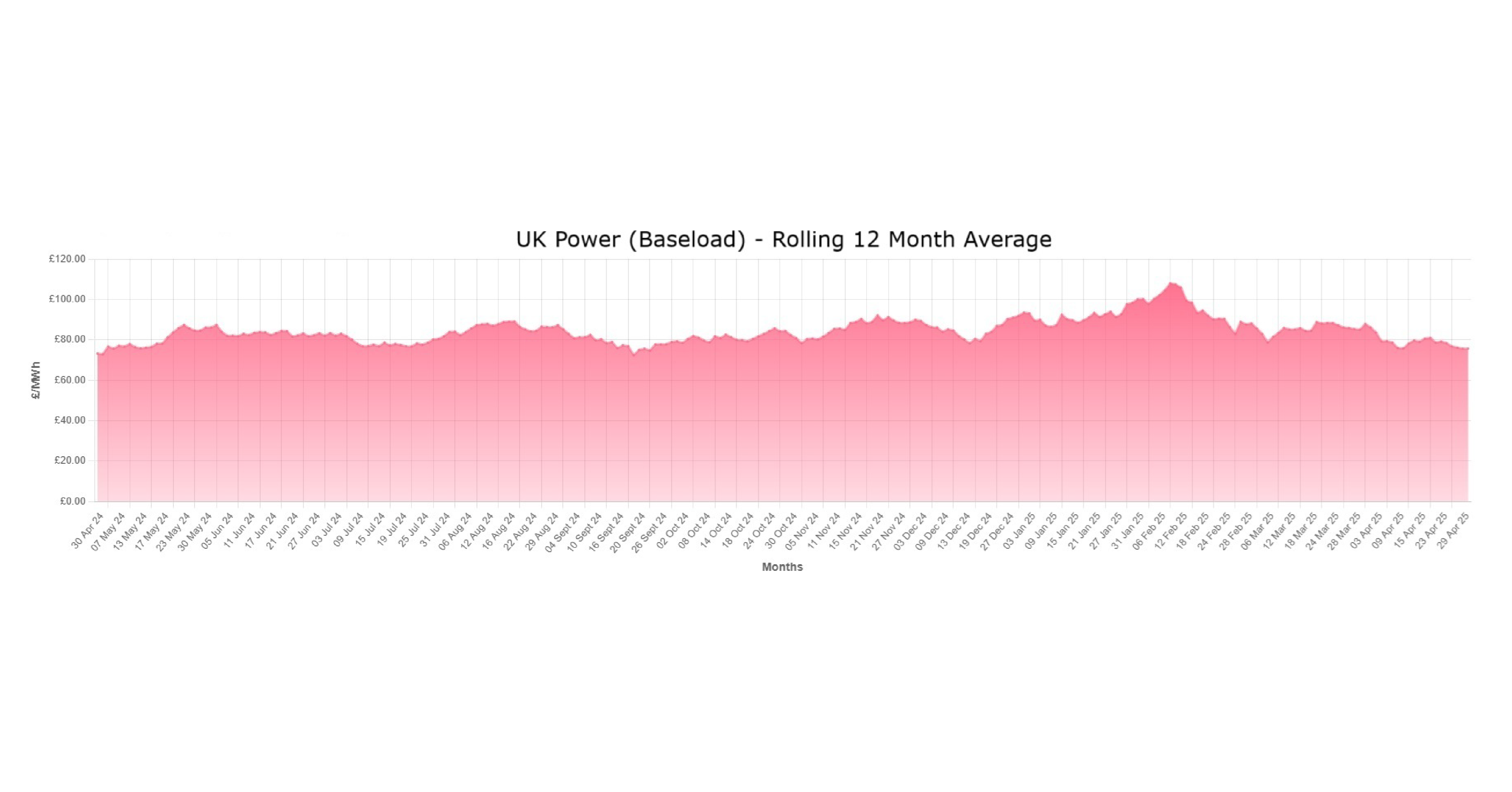

Power

If you would like the latest insights weekly, sign up for our Energy Market Update.

Weaker global demand and strong supply fundamentals continue to weigh on energy markets, offering fresh hedging opportunities.April was marked by...

Strong renewable output, combined with low demand (driven by mild weather and extended weekends across much of continental Europe) has put downward...

It has been a volatile month in energy markets, with sharp movements in oil and gas prices driven by the rapidly evolving situation in the Middle...